EUR/USD keeps red near 1.0570 level ahead of US trade balance

The EUR/USD pair has managed to bounce off few pips from session low but maintained its bearish bias for the second consecutive day.Currently trading around 1.0570-75 band, the pair's accelerated its rejection move from the 1.0600 handle, touched during early European session, and refreshed daily lows amid a mildly bullish sentiment surrounding the greenback, against the backdrop of rising possibilities for an eventual Fed rate-hike action in March.Meanwhile, the release of final Euro-zone Q4 GDP growth numbers, in-line with original estimates, extended little support to the shared currency, with the US Dollar price dynamics being an exclusive driver of the pair's movement on Tuesday.Today's US economic docket features the release of trade balance data and is unlikely to provide any fresh impetus for the pair's near-term trajectory.Investors' focus would remains on this week's key event risks - ECB monetary policy decision on Thursday and the keenly watch US monthly jobs report (NFP) on Friday, which would help determine the next leg of directional move for the major. Renewed weakness below 1.0560 level is likely to get extended towards 1.0535 intermediate support before the pair eventually drops to the key 1.0500 psychological mark support. On the flip side, the 1.0600 handle remains immediate strong barrier, which if conquered has the potential to lift the pair through three-week high resistance near 1.0640 level towards reclaiming the 1.0700 handle.

GBP/USD flirting with multi-week lows below 1.2200 handle

The selling pressure around the British Pound remains unabated, dragging the GBP/USD pair below the 1.2200 handle to its lowest level since Jan. 17.Currently trading around 1.2190-85 region, testing session lows, the pair remained under some selling pressure for the second consecutive day and accelerated its rejection move from 1.2300 handle as market participant remained focused on Brexit bill debate in the House of Lords. It is worth reporting that another rejection of the amended Brexit Bill, in the House of Lords, might endanger UK PM Theresa May's intension to trigger Article 50 of the Lisbon treaty by the end of this month. Meanwhile, a fresh wave of up-move in the US treasury bond yields further underpinned the US Dollar demand and collaborated to the pair's downslide to fresh 7-week lows. Next on tap would be the release of trade balance data from the US, which is unlikely to provide any fresh impetus for the major as market attention remains glued to any fresh developments / news around the Brexit bill ahead of this week's key event risk - the US monthly jobs report on Friday. A convincing break below 1.2185 level would turn the pair vulnerable to extend its bearish slide immediately towards mid-1.2100s, en-route 1.2115-10 horizontal support. On the flip side, any recovery might now confront immediate resistance near 1.2235 level, above which the momentum could get extended back towards the 1.2300 handle.

USD/JPY still targets the 115.00 area UOB

FX Strategists at UOB Group reiterated USD/JPY could extend the upside to the vicinity of the 115.00 handle in the next weeks.?The 113.45/50 target indicated yesterday was not met as USD rebounded after hitting a low of 113.53. The immediate downward pressure has eased and this pair has likely moved into a consolidation phase. Sideway trading is expected from here, likely within a 113.60/114.30 range?.?The ?rebound target? indicated at 114.95 is not met as USD fell sharply after touching a high of 114.74 last Friday. While the rapid pull-back has dented the upward momentum, another attempt to move towards 114.95 still seems likely. This is a rather strong resistance and is unlikely to break so easily. On downside, support is at 113.50 but only a move below 113.35 would indicate that a short-term top is in place?.

USD/CAD jumps back above 1.3400 handle ahead of data

Having posted a session low near 1.3385 region, the USD/CAD pair has managed to recover its lost ground and moved back to the 1.3400 handle. The pair's strong up-move since the beginning of last week, from the vicinity of 1.3100 handle, now seems to face a roadblock and has repeatedly failed to sustain / build on to its momentum above 1.3400 handle amid bullish consolidative price-action around the US Dollar.However, a weaker trading sentiment surrounding WTI crude oil, which tends to dent demand for the commodity-linked currencies - Loonies, has been lending some support and collaborated towards limiting any sharp near-term corrective slide for the major.Despite of the sluggish move in the past couple of trading sessions, the pair remains within striking distance of two-month highs near 1.3435-40 region touched on Friday. Tuesday?s economic docket, featuring the release of trade balance data from the US and Canada would be looked upon for short-term trading opportunities. However, the broader trend would remain dependent on the keenly watched NFP data, scheduled for release on Friday.Immediate resistance is pegged around 1.3425-30 region, above which the upward trajectory is likely to get extended towards 1.3460 area, en-route the key 1.3500 psychological mark.On the downside, 1.3380-75 region now seems to have emerged as immediate support, which if broken decisively might accelerate the corrective slide towards 1.3315 horizontal support before the pair eventually drops back to 100-day SMA support near 1.3285-80 region.

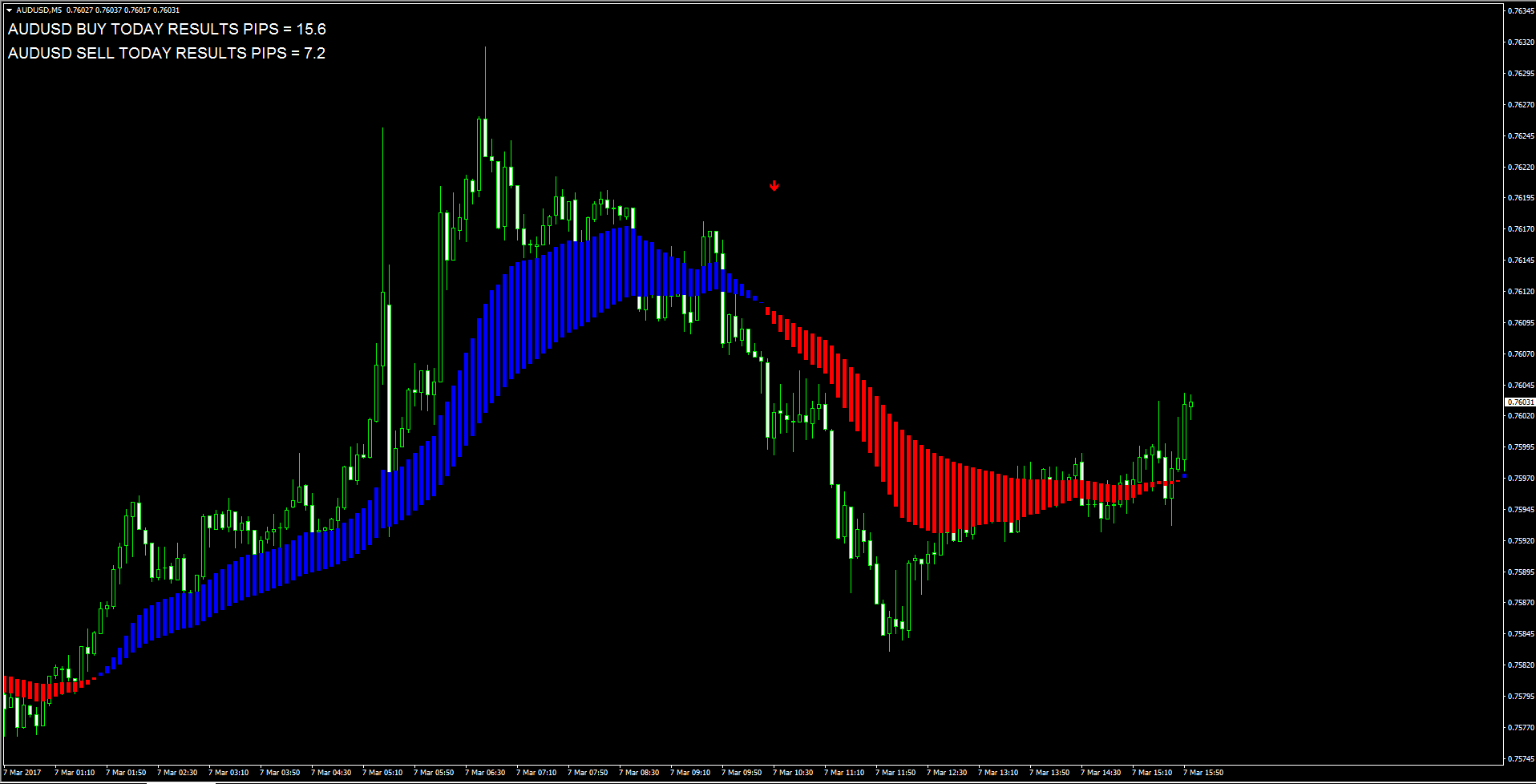

AUD/USD scope for a sell-off to 0.7520/0.7450 Commerzbank

The Aussie Dollar risks a potential test of the 0.7520/0.7450 area, suggested Karen Jones, Head of FICC Technical Analysis at Commerzbank.?The market sold off aggressively towards the end of last week and seeing a small rebound currently. The speed of the decline has increased the likelihood of a deeper sell off towards .7520 and possibly .7450 (the 38.2% and 50% retracements). Intraday rallies will remain directly offered below .7657 the 20 day ma. Intraday Elliott waves counts are negative?.?The market is failing ahead of the .7778/.7850 2016 highs and the 38.2% retracement?.?Above .7850 would target the 200 month ma at .7939?.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.