EUR/USD muted post-EMU CPI

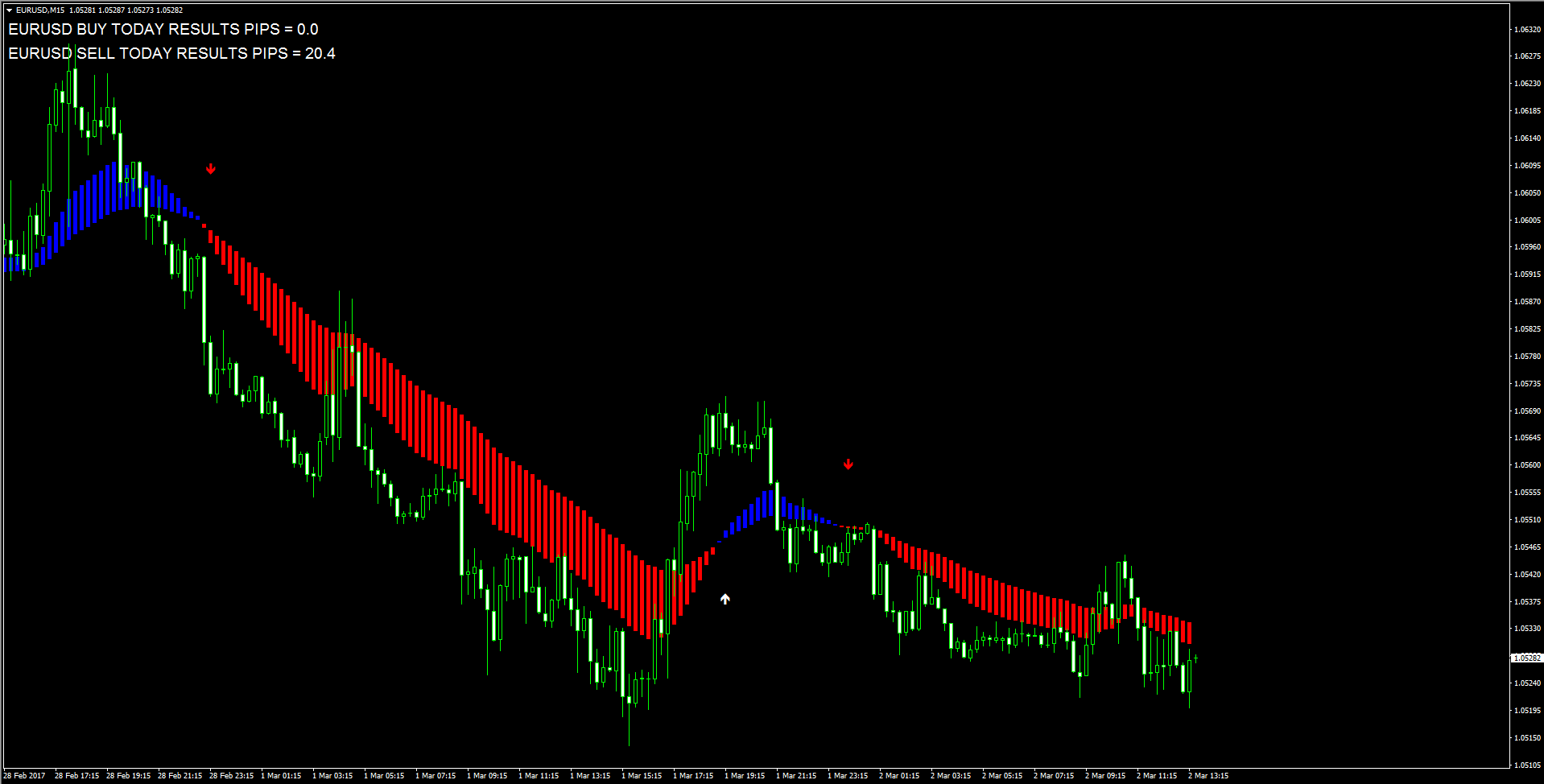

EUR/USD maintains its daily range following the release of advanced inflation figures in the euro region.The pair remained apathetic after preliminary inflation figures in Euroland showed consumer prices are expected to rise at an annualized 2.0% during February, matching prior surveys and up from January?s 1.8%. Core Prices rose at an annualized 0.9%.In the meantime, the persistent buying sentiment around the buck keeps the pair under pressure close to the critical support at 1.0500 the figure ahead of the key speech by Chief J.Yellen on Friday.Collaborating with the pair?s decline, recent Fedspeak and auspicious results from the US docket have lifted US yields, adding to the view of a stronger buck. Furthermore, New York Fed and permanent FOMC voter W.Dudley said earlier in the week that the case for further tightening has become ?compelling?, while Dallas Fed R.Kaplan noted that the next rate hike would come ?in the near future?.At the moment the pair is losing 0.20% at 1.0526 and a breach of 1.0522 (low Mar.2) would open the door to 1.0492 (low Feb.22) and finally 1.0452 (low Jan.11). On the flip side, the next hurdle lines up at 1.0594 (55-day sma) followed by 1.0619 (20-day sma) and then 1.0632 (high Feb.28).

GBP/USD unchanged below 1.2300 post-PMI

The bearish stance around the British Pound remains well and sound today, with GBP/USD extending the consolidative range below 1.2300 the figure.Cable kept the composure after UK?s Construction PMI measured by Markit came in a tad above estimates at 52.5 for the month of February vs. 52.0 initially forecasted and January?s 52.2.Spot stays well in the red territory today, losing ground for the fifth session in a row and navigating fresh 6-week lows for the time being.As of writing the pair is losing 0.11% at 1.2280 and a break below 1.2262 (low Mar.2) would aim for 1.2250 (low Jan.19) and finally 1.2036 (low Jan.11). On the flip side, the initial up barrier aligns at 1.2301 (high Mar.2) followed by 1.2395 (55-day sma) and then 1.2410 (100-day sma).

USD/JPY near term stance stays positive Commerzbank

Karen Jones, Head of FICC Technical Analysis at Commerzbank, noted the pair?s outlook remains constructive in the near term.?The market continues to recover from the bottom of the range at 111.59 and we can only assume that we are about to test the 55 day ma at 114.74. We view the recent low at 111.59 as an interim low. Between 111.59/114.66 the market is side lined. A close above the 115.62 19th January high is needed to reintroduce scope to the key short term resistance offered by the 16 month resistance line at 117.84 and this remains our favoured view?.?Only below 111.59 would introduce scope to Fibonacci support at 109.92 and, if seen, the 200 day ma at 107.73. We look for this to hold (this is also the 50% retracement of the move up from November). However this is not our favoured view - we also note that the recent move lower continues to indicate that this is the end of the corrective move?.

USD/CHF tracks DXY lower, ignores mixed Swiss data

The USD/CHF pair brought an end to its steady recovery mode in the European morning, and drifted lower over the last hour in a bid to retest 1.0100 levels.Currently, the USD/CHF pair trades +0.11% higher at 1.0102, reversing a spike to daily highs posted at 1.0118. The major trims gains in tandem with the US dollar index, as the greenback ran into resistance at 102 handle against its six major rivals.The USD dynamics continue to remain the key driver for the pair, as investors ignore latest fundamentals reported out of the Swiss docket.The Swiss Q4 2016 GDP data disappointed markets, arriving at 0.1% q/q versus 0.5% expectations, while the retail sales for Jan bettered expectations, coming in at -1.4% versus -3.5% previous and -2.0% expected.All eyes now remains on the US jobless claims for fresh momentum on the prices.To the upside, the next resistances are seen near 1.0118/20/23 (daily high/ Feb 15 high/ Fib R1) and 1.0142/44 (Feb 22 high/ Fib R2) and from there to 1.0176 (classic R2). To the downside, immediate support might be located at 1.0091/86 (daily pivot/ 5 & 100-DMA) and below that at 1.051/43 (20 & 50-DMA) and at 1.0000 (parity).

AUD/USD: Commodity prices point to 0.70s/ near 0.80 - Westpac

Sean Callow, Research Analyst at Westpac, explains that their recent theme remains very much intact: commodity prices point to AUD/USD in the high 0.70s/ near 0.80, global risk sentiment is also very supportive and the RBA is looking on the bright side of mixed domestic data, keeping rate cut talk at bay. ?But AUD should be capped against USD by the Fed?s increasingly hawkish rhetoric.??This suggests that not only do the early Nov highs around 0.7775 remain intact but that we may not even retest the late Feb 0.7740 area. Still, any shorts above 0.77 would have to be very unambitious in terms of downside targets.??AUD/USD hasn?t traded below 0.7600 since 2 Feb when the record trade surplus for Dec was released. The $2bn slump in the surplus in Jan is likely to be a statistical blip that doesn?t have a lasting impact on AUD. Look for further gains on crosses, including clear outperformance within the dollar bloc despite a neutral AUD/USD weekly bias.?

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.