EUR/USD challenging lows near 1.0580

The greenback has managed to revert the initial negative tone and is now pushing EUR/USD to fresh lows in the proximity of 1.0580.Spot has failed to extend its initial gains further north of 1.0640 on Monday, sparking instead a correction lower to the area of daily lows near 1.0580 for the time being.The greenback, in the meantime, seems to have recovered the smile after briefly losing the grip last Friday despite the supportive message from Chief J.Yellen at her speech in Chicago on ?Economic Outlook?.The optimism around EUR seems to have diluted after another elections poll from OpinionWay showed this morning that far-right presidential candidate Marine Le Pen continues to lead the vote intentions with 27% vs. candidate Emmanuel Macron in the first round, while the independent centrist would win a second round 60%-40% (prev. 62%-38%).Somewhat supporting EUR, net shorts have receded to 2-week lows while Open Interest kept rising in the week to February 28, as per the latest CFTC report.Data wise, better-than-expected Sentix index in the euro region did nothing to curb the selling mood around the common currency, while January?s Factory Orders and the speech by Minneapolis Fed N.Kashkari (voter, centrist) are due later in the US calendar. At the moment the pair is losing 0.30% at 1.0589 and a breakdown of 1.0492 (low Mar.2/Feb.22) would target 1.0452 (low Jan.11) en route to 1.0339 (2017 low Jan.3). On the upside, the next resistance appears at 1.0654 (short term resistance line) seconded by 1.0675 (100-day sma) and finally 1.0682 (high Feb.16).

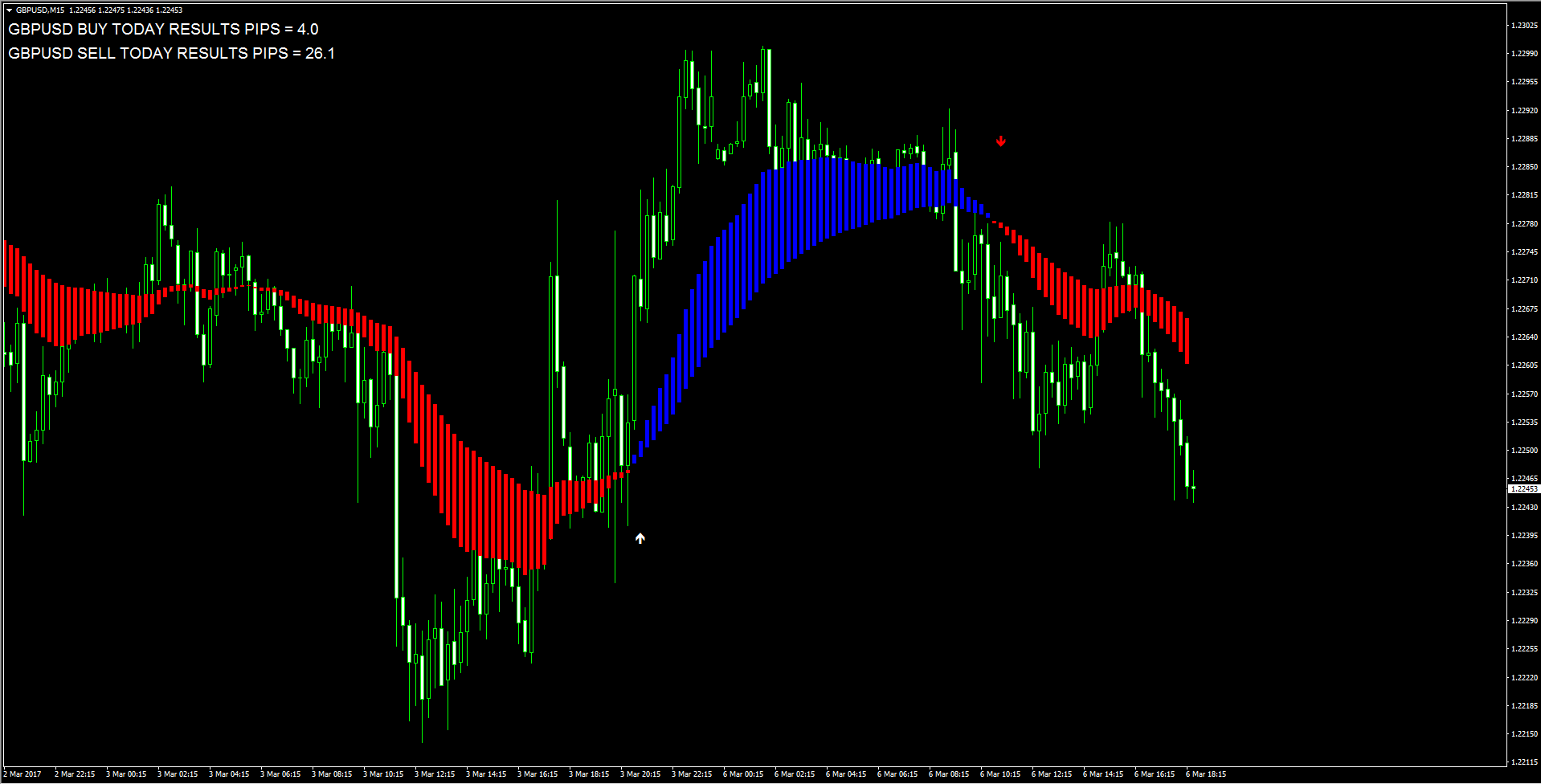

GBP/USD reverse Friday's tepid recovery from six week lows

The GBP/USD pair's recovery from six week lows ran out of steam near 1.2300 handle and has now reversed all of Friday's tepid recovery gains.Currently trading around mid-1.2200s, the pair remained under some selling pressure for sixth trading session, in the previous seven, amid renewed US Dollar buying interest in wake of growing bets for an eventual Fed rate-hike action at its upcoming meeting next week. Moreover, investors remained reluctant from buying into the British Pound, against the backdrop of renewed Brexit worries after the House of Lords voted to amend the Brexit bill and ahead of the UK Annual Budget release on Wednesday.On the economic data front, the US factor orders data, later during NA session, would be looked upon to grab some short-term trading opportunities.A follow through selling pressure is likely to increase the pair's vulnerability to head back towards 1.2215 level (Friday's low) before eventually breaking below 1.2200 handle and extending the downslide further towards 1.2155-50 horizontal support.On the upside, 1.2300 handle remains immediate strong resistance, above which the recovery momentum could get extended towards 1.2345-50 area, en-route an important horizontal resistance near the 1.2400 handle.

USD/JPY off lows, still weaker below 114.00 handle

The USD/JPY pair has managed to bounce off session low near mid-113.00s but remained in negative territory for the second consecutive session.Against the backdrop of geopolitical tensions North Korea ballistic missiles test, a fresh wave of worries over the political uncertainty in the Euro-zone, following former French Prime Minister Alain Juppe's statement that he won?t enter the race for the Presidency, provided an additional boost to the Japanese Yen's safe-haven appeal and kept the major under some selling pressure through European trading session.Meanwhile, renewed US Dollar buying interest, in wake of growing market consensus for a March Fed rate-hike action, has failed to benefit the pair, albeit did help the major to bounce off around 25-pips from three day lows. Later during NA session, the release of US factory orders might provide some impetus for short-term traders, while broader market risk-sentiment would remain a key determinant of the pair's movement on Monday. A daily close above the channel resistance would add credence to the argument that the spot has bottomed out at 111.60 (Feb low) and open doors for a revisit to 118.66 (Dec 15 high). The RSI is already above 50.00, pointing to a potential bullish break ahead."

EUR/JPY focus is now on 121.35 Commerzbank

In opinion of Karen Jones, Head of FICC Technical Analysis at Commerzbank, the cross should now shift its focus to the 121.30 area.?EUR/JPY continues to see a strong recovery off from the 118.45/35 band of support this is the location of the 50% retracement of the move up from October, the 38.2% retracement of the move up from June 2016 and the July 2016 high. Rallies have regained the 20 day ma and the focus has shifted to the 10th Feb high at 121.35?.?Looking for strong recovery off the 118.50-116.37 band ahead of recovery?.?Below 118.25 lies the 117.63 200 day ma and the 116.69/37 50% retracement?.

AUD/USD looks increasingly stretched RBC CM

Elsa Lignos, Research Analyst at RBC Capital Markets, notes that AUD/USD ran into resistance in late February just above 0.7740 and has come off 2% in early March, but it remains the top-performing G10 currency YTD, vying for global first place with ZAR.?For those tracking rate dynamics, AUD/USD looks increasingly stretched. AUD/USD against 2 year AU-US rate differentials; while spreads have moved 30bps in the US?s favour since Jan 1, AUD/USD is still up nearly 5%. But as we have been arguing for a while, rate spreads are not the story. (1) Part of the explanation is outright yield (the return of the G10 carry trade means AUD benefits from its status as a relative high yielder in G10). But AUD is also up ~4% YTD against its higher-yielding cousin NZD, so that is clearly not the only driver. (2) AUD benefits from deeper asset markets relative to NZ and unhedged inflows. Capital from Japanese investors has continued flowing into AU bonds. December inflows (the last month for which we have data) were AUD1.6bn, more modest than the November inflow of AUD3.4bn but still showing remarkable resilience in the face of rallying AUD/JPY. Japanese buying only makes sense on an unhedged basis (AU is the highest-yielding liquid G10 market), which means AUD buying. (3) AUD is benefiting from the huge rally in iron ore (prices up 80% in six months, +22% YTD, though down 7% off the late Feb high). That has also supported other hard commodity exporters like ZAR and BRL.? ?For the rest of Q1, AUD may face some downside risk from the January reversal effect. In a nutshell, we have found that January moves tend to reverse in AUD, CAD and NZD through Feb/March. But beyond that we remain constructive on AUD, at least on key crosses. We have revised our end-Q2 forecast marginally higher to reflect (0.75 from 0.74).?

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.