EUR/USD under pressure around 1.0620

The pick up in the greenback has prompted EUR/USD to retreat from previous daily tops and re-visit the low-1.0600s.After briefly testing daily lows near 1.0600 the figure during early trade, the pair remains confined to a narrow range, with gains so far capped around the 200-hour sma near 1.0630. In the meantime, the greenback remains steady in the 100.80 region when tracked by the US Dollar Index, a tad lower than recent tops in the 101.00 neighbourhood, all against the backdrop of supportive Fedspeak as of late, hawkish comments by Chair Yellen and positive results from US fundamentals. Looking ahead, advanced PMIs in Euroland are due tomorrow, ahead of the German IFO and the FOMC minutes on Wednesday. The greenback is poised to stay in centre stage in light of the minutes and expected Fedspeak. Adding to the lack of direction in EUR, speculative net shorts have increased to 3-week highs during the week ended on February 14, as shown by the latest CFTC report. At the moment the pair is up 0.01% at 1.0616 facing the next hurdle at 1.0682 (high Feb.16) followed by 1.0688 (20-day sma) and finally 1.0706 (38.2% Fibo of the November-January drop). On the flip side, a breach of 1.0520 (low Feb.15) would target 1.0452 (low Jan.11) en route to 1.0339 (2017 low Jan.3)

GBP/USD stick to recovery gains

The GBP/USD pair extended bounce off a short-term ascending trend-line support, and has now reversed majority of Friday's disappointing UK retail sales-led slide to sub-1.2400 level.The pair, however, trimmed some of its gains to session peak level near 1.2480 region and is currently trading around 1.2455-60 region. Despite of the pull-back, the pair has managed to maintain its strong bid tone and in absence of any market moving economic releases, Monday's recovery could be attributed to some short-covering amid largely subdued US Dollar price-action and repositioning ahead of House of Lords debate on Article 50, later during the day. Meanwhile, holiday thin market liquidity conditions, in wake of a holiday in the US markets, could have contributed towards aggravating the move and infusing some volatility around the major.Meanwhile, focus would remain on this week's key event risks - the second estimate of UK GDP growth numbers and the FOMC meeting minutes, which would help investors to determine the next leg of directional move for the major.Momentum above session peak resistance near 1.2480 level could get extended towards 1.2500 psychological mark above which the pair seems all set to head towards 1.2565-70 resistance area ahead of 1.2600 round figure mark.On the downside, retracement back below 1.2440 level, leading to a subsequent break below 1.2420 area, could drag the pair back towards the ascending trend-line support near 1.2400 handle, which if broken decisively might accelerate the slide towards 1.2350-45 area before the pair eventually breaks below 1.2300 handle and head towards testing its next support near 1.2260-55 region.

USD/JPY upside stalled near 113.20

The Japanese Yen is posting moderate losses vs. its American counterpart at the beginning of the week, sending USD/JPY to the area of daily highs in the 113.15/20 band.The pair is advancing for the first time after three consecutive pullbacks, regaining the critical 113.00 handle and above while at the same time recovering the smile and bouncing off Friday?s multi-day lows in the vicinity of 112.60.The buck tracked by the US Dollar Index is alternating gains with losses today, although the weakness around the Japanese safe haven seems to be quite extended.It will be a very light week on the Japanese data front, leaving the bulk of the attention to the USD dynamics, with the FOMC minutes on Wednesday taking centre stage and seconded by several Fed speakers throughout the week. In the positioning space, JPY speculative net shorts have been trimmed to levels last seen in early December in the week to February 14 according to the latest CFTC report.As of writing the pair is advancing 0.27% at 113.15 facing the initial hurdle at 114.36 (high Feb.16) followed by 114.97 (high Feb.15) and finally 115.39 (high Jan.27). On the flip side, a breakdown of 112.58 (low Feb.17) would aim for 112.03 (low Feb.2) and then 111.57 (low Feb.7).

USD/CAD gains some traction despite of positive oil prices

The USD/CAD pair gained some fresh traction for the second consecutive day on Monday but still remains confined within 6-day old broader trading range below the very important 200-day SMA. On Friday, the pair did attempt a break through the recent trading range but failed to sustain its move above 1.3100 handle. On Monday the pair was seen reattempting to build on to its move back above 1.3100 handle despite of a positive trading sentiment surrounding oil markets, which tends to benefit the commodity-linked currency - Loonie. In fact, WTI crude oil has now moved back above $54.00/barrel mark, with a gain of over 0.50%, and might contribute towards restricting any immediate sharp upside for the major. Meanwhile, a subdued greenback price-action, with the key US Dollar Index stuck in a narrow band near 100.85 region, has not be supportive of the pair's up-move on Monday. With the US markets closed on Monday, traders would take cues from the release of monthly Canadian Wholesale Sales data in order to grab some short-term trading opportunities. Moreover, market sentiment surrounding the greenback and oil market would also collaborate towards determining the pair's movement, if any, on Monday.Currently trading around 1.3110-15 region, any subsequent move above 1.3125 region (Friday?s high) might confront resistance at 200-day SMA near 1.3140 region above which a fresh bout of short-covering has the potential to lift the pair beyond 1.3200 handle towards 50-day SMA resistance near 1.3220 region. On the flip side, sustained weakness below 1.3080, leading to a subsequent break below 1.3055-50 region, might continue to find support near 1.3020-10 region. A convincing break below 1.3020-10 support would turn the pair vulnerable to continue drifting lower in the near-term.

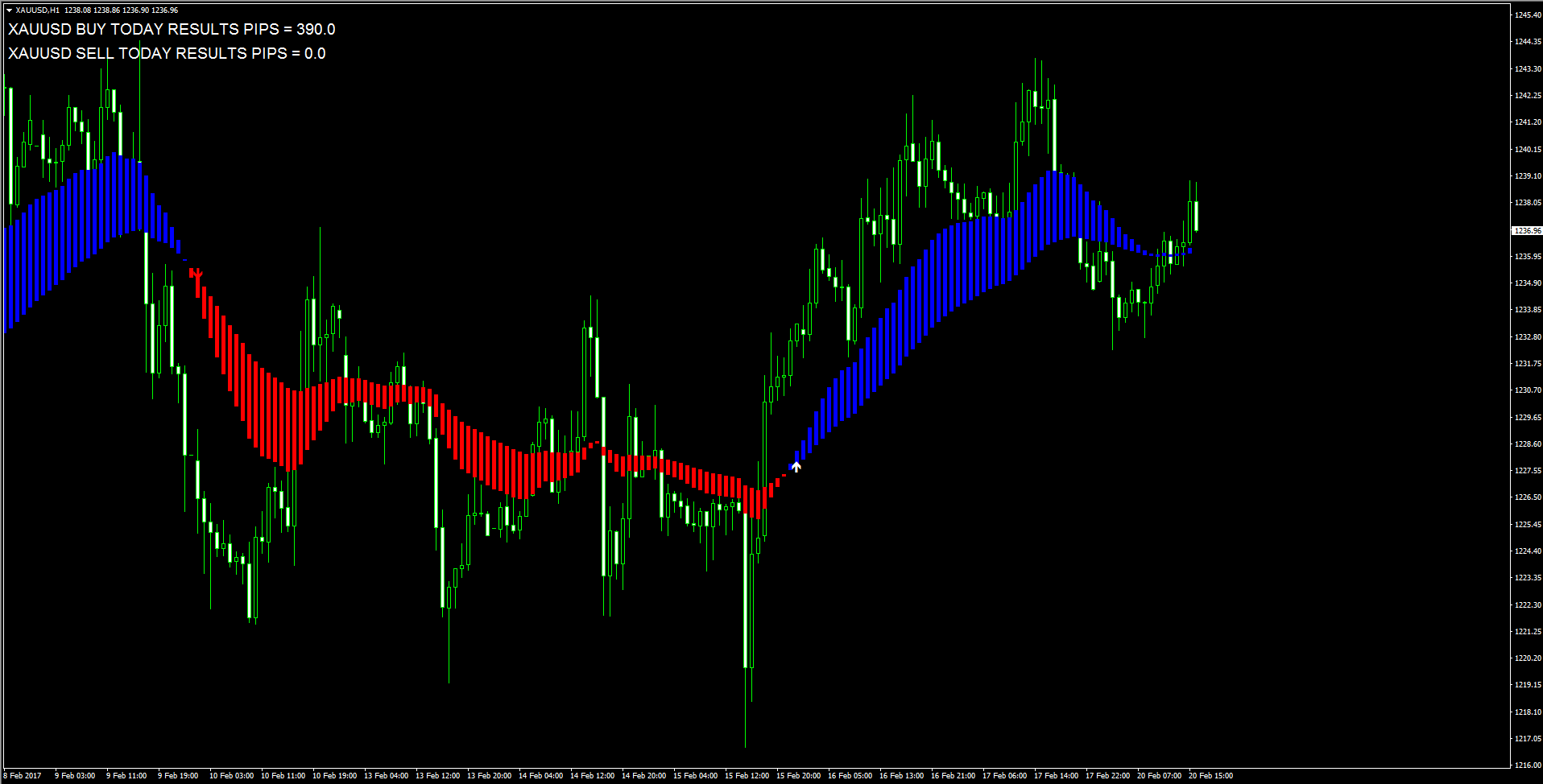

Gold inter-markets

Having posted a session low near $1232 region, gold regained traction and touched a fresh session peak level of $1238 during early NA session. A mild retracement in the US equity indices futures, which tends to benefit traditional safe-haven assets, has been a key factor of the metal's latest leg of up-move on Monday. Moreover, the political uncertainty in Europe, ahead of the crucial French Presidential election, has also been supportive of the metal's investment appeal. Meanwhile, a range-bound price action around the US treasury bond yields, and the key US Dollar Index amid thin market liquidity conditions in wake of a bank holiday in the US, has failed to provide any impetus and broader market risk-sentiment remains an exclusive driver of the metal's move on the first trading day of the week. Looking at the broader picture, the precious metal has been trading in the vicinity of three-month peaks touched during early Feb. as investors remained skeptic over the US President Donald Trump's pro-economic policies. Furthermore, market participants also preferred to wait of the sideline ahead of this week's key event risk - FOMIC meeting minutes on Wednesday. The Fed minutes would be looked upon for fresh fresh insight over the possibilities and timing of the next Fed rate-hike action, eventually provide fresh impetus for the non-yielding yellow metal's near-term trajectory

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.