EUR/USD eyes a break below 1.0600 on data

The EUR/USD pair failed to sustain at higher levels above 5-DMA (1.0626), and now reverts towards 1.06 handle, following the release of the economic data from Germany and Eurozone.Currently, the spot now trades +0.09% higher at 1.0609, testing session lows struck previously at 1.0607, where 50-DMA intersects. The euro remains unimpressed by mixed Eurozone datasets as well as on disappointing German ZEW surveys.Eurozone flash Q4 GDP arrived at 0.40% q/q vs. est 0.50% and prev 0.50%, while the bloc?s industrial production data bettered expectations, coming in at 2.00% y/y vs. est 1.70% and 3.20% last. The German Feb ZEW current situation stood at 76.4 vs 77.0 expected.The main currency pair remains vulnerable amid a series of below estimates fundamentals, while a broad based recovery in the greenback also drags the EUR/USD pair away from the daily tops reached at 1.0633. All eyes now remain on the US PPI data and Fed Yellen?s testimony before the Senate Banking Committee due later in the NA session.In terms of technicals, the pair finds the immediate resistance 1.0679/84 (100 & 10-DMA). A break beyond the last, doors will open for a test of 1.0710 (20-DMA) and from there to 1.0751 (Feb 7 high). On the flip side, the immediate support is placed at 1.0605 (50-DMA) below which 1.0587 (Jan 19 low) and 1.0550 (psychological levels) could be tested

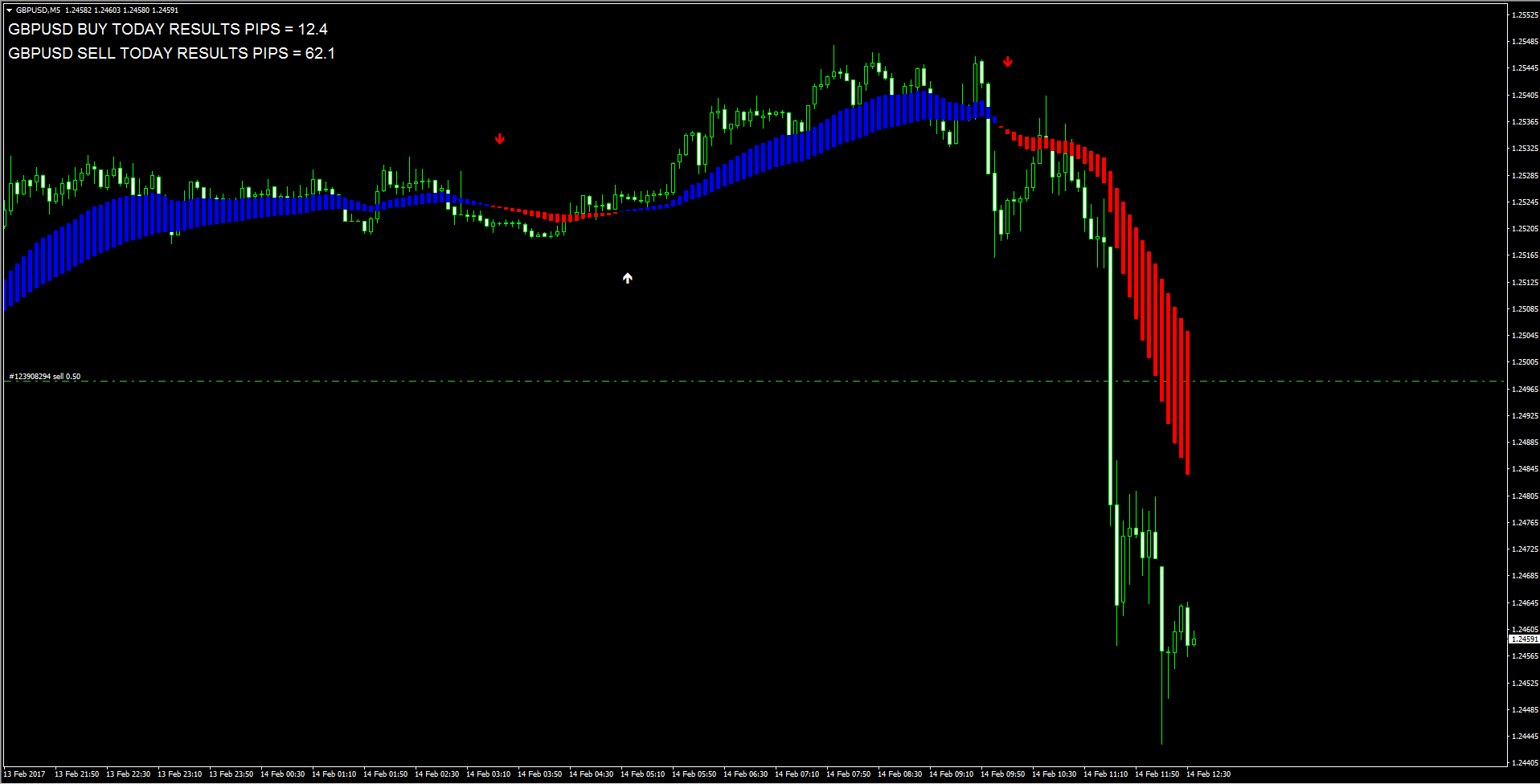

GBP/USD breaks below 1.2500 post-UK CPI

The selling interest around the Sterling has picked up extra pace in the wake of UK CPI figures, with GBP/USD trading back below the 1.2500 mark.The downside momentum in spot gathered further traction after inflation figures tracked by the CPI rose less than expected 1.8% YoY during the month of January, missing initial estimates. On a monthly basis, consumer prices contracted 0.5%.In addition, prices stripping Energy costs rose at an annualized 1.6%.Ahead in the week, UK?s labour market report is due tomorrow, while Retail Sales are expected on Friday.As of writing the pair is down 0.35% at 2481 and a breakout of 1.2572 (high Feb.7) would open the door to 1.2680 (high Jan.26) and finally 1.2715 (high Feb.2). On the flip side, the immediate support aligns at 1.2436 (low Feb.10) followed by 1.2344 (low Feb.7) and finally 1.2250 (low Jan.19).

USD/CAD decline finds support near 1.3050

Today softer tone in the greenback has dragged USD/CAD to the area of session lows near 1.3050, where it seems some buyers have turned up.Spot remains on the defensive since last Friday, extending the leg lower after being rejected from last week?s tops just above 1.3200 the figure.CAD seems to have derived some support from the recent rally in crude oil prices, although its sensitiveness to crude dynamics has lost momentum as of late. Yield spreads between US and Canadian money markets stay as the other driver for the pair?s price action, although too, it lost momentum in recent sessions.Later in the day, Yellen?s semi-annual testimony before the Senate Banking Committee is due along with US Producer Prices, NFIB?s Optimism index and speeches by Richmond Fed J.Lacker (2018 voter, hawkish), Dallas Fed R.Kaplan (voter, centrist) and Atlanta Fed D.Lockhart (who will step down at the end of the month).Recent cordial meeting between PM J.Trudeau and President D.Trump yielded no major news, with Trump emphasizing the relationship between the two countries as ?outstanding?.As of writing the pair is losing 0.11% at 1.3057 facing the next support at 1.3046 (low Feb.13) seconded by 1.3016 (low Jan.17) and then 1.2967 (low Jan.31). On the other hand, a surpass of 1.3131 (20-day sma) would aim for 1.3142 (200-day sma) and finally 1.3215 (high Feb.7).

AUD/USD potential for a break higher Commerzbank

In view of Karen Jones, Head of FICC Technical Analysis at Commerzbank, the pair stays poised for a potential break higher.?AUD/USD is consolidating tightly sideways and is well placed to break higher the Elliott count on the daily chart is pointing to a .7570/.7490 retracement ahead of another upside attempt and we remain unable to rule out minor slippage into this band. However currently the market seems well supported by the 20 day ma at .7602?.?Last week, the market eroded the 2013-2017 downtrend and cleared the .7645 Fibo resistance and in doing so has introduced scope to the .7778/.7850 2016 highs and the 38.2% retracement. Directly above here lies the 200 month ma at .7930. Very near term we would allow for a dip to .7470/.7490 ahead of further gains?. ?We suspect that prices will need to go sub 7435, the 55 day ma, to alleviate upside pressure and trigger losses to .7312/00 then .7161/64, the recent lows?.

EUR/GBP in daily highs above 0.8500 on UK inflation

The bout of weakness around the British Poind is now pushing EUR/GBP to the area of session highs beyond the critical barrier at 0.8500 the figure.The European cross is posting gains for the first time after six consecutive sessions, coming down from last week?s tops in the mid-0.8600s and looking to extend the rebound from the area of 2-month lows near 0.8450.Today?s UK CPI figures have come in below estimates, hurting GBP and adding to the cross upside. In fact, headline prices rose 1.8% on a yearly basis and contracted 0.5% inter-month during January.On another direction, the resilience around GBP has been behind the recent 2-cent drop in the cross, exacerbated further by the renewed selling pressure around the EUR seen in past sessions.GBP remains well supported by alleviated concerns of a ?hard Brexit? scenario in light of the imminent triggering of Article 50, while UK fundamentals has been also collaborating with GBP-buying as of late.The cross is now up 0.69% at 0.8518 and a break above 0.8557 (high Feb.8) would expose 0.8560 (20-day sma) and then 0.8648 (high Feb.6). On the flip side, the next support aligns at 0.8451 (low Feb.13) ahead of 0.8446 (2017 low Jan.3) and finally 0.8298 (low Dec.5 2016).

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.