EUR/USD slips back to 1.0730 ahead of NFP, daily lows

The single currency is intensifying its daily downside on Friday, dragging EUR/USD to test fresh lows in the vicinity of 1.0730.The pair continues to fade the weekly rally above the 1.0800 handle seen on Thursday, now losing around a cent since the spike to the 1.0830 area.Spot is retreating for the third session in a row so far today amidst quite a moderate pick up in the demand for the US Dollar, which has retaken the psychological 100.00 handle when gauged by the US Dollar Index.Data wise in Euroland, final Services PMIs for the month of January have come in on the strong side, while EMU?s Retail Sales have contracted 0.3% on a monthly basis in December vs. a forecasted 0.3% expansion.Later in the NA session the pair will remain under pressure in light of the release of US Non-farm Payrolls for the last month (175K exp.), December?s Factory Orders, Markit?s Services PMI and the ISM Non-manufacturing. In addition, Chicago Fed Charles Evans (voter, dovish) is also due to speak. The pair is now losing 0.25% at 1.0732 and a break below 1.0683 (20-day sma) would target 1.0617 (low Jan.30) en route to 1.0597 (55-day sma). On the upside, the initial hurdle sits at 1.0789 (100-day sma) followed by 1.082 (high Feb.2) and then 1.0848 (low Oct.25 2016).

GBP/USD potential drop to 1.2428 Commerzbank

Karen Jones, Head of FICC Technical Analysis at Commerzbank, noted Cable could slip back towards the 1.2430 region.?GBP/USD is interesting it has actually been contained in a channel since October and yesterday we rejected by the top of that channel at 1.2712. To complicate matters further we note the divergence of the daily RSI and the two combined suggest a spell of weakness. We would allow for a slide back to the 55 day ma at 1.2428 and potentially 1.2253 the 18th January low?.?We suspect that prices will need to go sub 1.2250 in order to alleviate immediate upside pressure. Support at 1.2250 guards the 1.1988/80 recent low?.?Above 1.2712 would allow for further strength to the 1.2776 December high. Between here and 1.2836 lies several Fibonacci retracements and major resistance and we suspect that it will struggle here?.

USD/JPY clings to recovery gains above 113.00 handle

The greenback extended its recovery move, heading into the key NFP data, helping the USD/JPY pair to hold on to its recovery gains back above 113.00 handle.Currently trading around 113.15 region, just shy of session peak level of 113.25 touched during early European session, traders continue to lighten their bearish USD bets in anticipation of strong headline number. Needless to say, that a combination of upbeat average earnings growth would help the key US Dollar Index to extend its recovery move from Thursday's 11-week lows. Moreover, the pair has repeatedly bounced off 112.00 handle, which could have further prompted a short-covering bounce despite of a disappointment from BoJ's bond purchase operations, which failed to keep a lid on rising yields. In fact, the 10-year JGB yields rose to fresh one-year high of 0.150% and dragged the pair to intra-day low near 112.50 region.Despite of its recovery from session low, and subsequent move above 113.00 handle, the pair lacked follow through momentum as investors preferred to remain on the sidelines ahead of the keenly watched US jobs data, slated for release in a short while from now. A daily close below 112.32 (channel support) would signal continuation of the retreat from the recent high of 118.66 and open doors for a sell-off to 110.00 levels. Weak US wage growth numbers could see the pair break below 112.32 levels. On the higher side, a break above 114.00 could yield a revisit to channel hurdle seen at 115.15."

AUD/USD inter-markets: Eyes 0.7570 on lower copper, solid NFP

AUD/USD paused its five-day rally on Friday, as the ongoing bullish move lacked momentum, with traders taking profits off the table heading into the big risk event for today the US NFP data.The Aussie is seen consolidating the recent upsurge backed by recent Trump-led USD weakness and record high trade surplus data. However, over the last hours, downside risks are seen opening up in the major, in wake of tumbling copper prices and a pick-up in demand for the US dollar amid rising treasury yields.Copper futures on Comex slump -1.30% to $ 2.65 per pound, while the USD index advances +0.16% to 100 marker. The benchmark 10-yr treasury yields rebound +0.70% so far this session. Higher treasury yields usually diminish the demand for AUD as an alternative higher yielding currency.Further, a majority of the analysts expect 200k job additions in the US economy in the month of Jan, while average hourly earnings are also expected to tick higher alongside a drop in the US unemployment rate. Therefore, its widely expected that a solid US jobs report will provide extra legs to the corrective rally in the greenback against its main competitors, which will eventually accelerate the decline in AUD/USD towards yesterday?s low and hourly 200-SMA located near 0.7570 region.

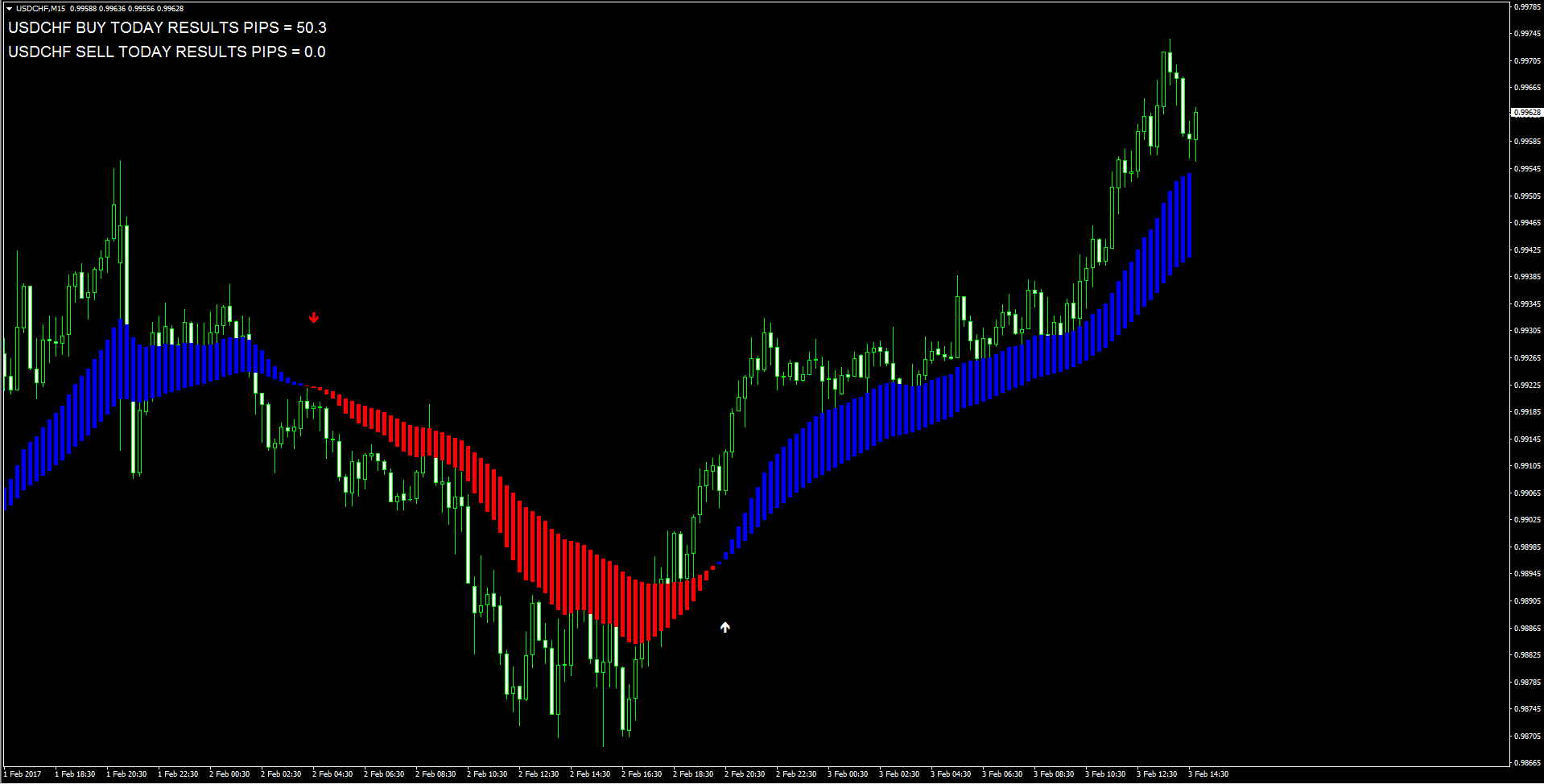

USD/CHF rallies still capped around 1.0002 Commerzbank

According to Karen Jones, Head of FICC Technical Analysis at Commerzbank, the pair?s occasional bullish attempts should struggle near 1.0002.?USD/CHF is bouncing from the 200 day ma at .9876, the 55 week ma also lies here at .9867 and the 61.8% Fibo is found at .9853. We would allow for a small recovery but note that rallies are likely to remain capped by the short term downtrend at 1.0002. Below .9850 would introduce scope to the 78.6% retracement at .9720?.?A close above 1.0002 is needed to alleviate downside pressure and generate some upside interest to 1.0248 11th January high and the 1.0328 2015 and 1.0344 December 2016 highs?.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.