EUR/USD stuck around 1.0430 ahead of FOMC

EUR/USD keeps its bid tone well and sound today, navigating the 1.0430 area after dropping to fresh 14-year lows in the 1.0340/35 band on Tuesday.Spot has regained the 1.0400 handle and beyond today, managing to rebound from fresh 14-year troughs near 1.0340 area on Tuesday as the rally in the greenback seems to have run out of steam for the time being.The upside momentum around EUR lacked of follow through today despite advanced inflation figures in the euro bloc showed consumer prices are expected to rise more than initially estimated for the month of December.Later in the NA session, the current upside will be put to the test as market consensus expects the FOMC minutes to come in on the hawkish side, with the ?dots plot? and the potential overshooting of the Fed?s employment and inflation goals likely to be on top of the debate.The ongoing resilience around EUR finds extra support on the positioning front, as speculative net shorts have decreased to levels last seen in late June 2016 during the week ended on December 27, according to the latest CFTC report.The pair is now up 0.20% at 1.0427 and a breakout of 1.0534 (high Jan.2) would target 1.0654 (spike Dec.30) en route to 1.0687 (55-day sma). On the downside, the immediate support aligns at 1.0350 (2016 low Dec.20) ahead of 1.0339 (2017 low Jan.3) and finally 1.000 (psychological level).

GBP/USD recovery gains momentum, hits fresh session peak

The GBP/USD pair was seen building on to its Wednesday?s recovery move and has now reversed all of its losses posted in the previous session. Currently trading around 1.2275 region, the pair was seen benefiting from upbeat UK data, including UK construction PMI for December, which surpassed expectations and added to the recent slew of upbeat UK economic data and provide some immediate respite for the major. Moreover, a broad based US Dollar retracement is also collaborating to the pair?s recovery trend on Wednesday. It would, however, be interesting to see if the pair manages to sustain the strength and builds on to the recovery momentum amid prevailing uncertainty over the economic implication of Brexit, which might hold back investors from initiating fresh long positions and restrict any meaningful recovery in the major. Moreover, traders also seemed cautious ahead of FOMC meeting minutes, due later during NY session, which if reveals prospects of stronger US economic growth would reinforce expectations of additional Fed rate-hike actions in 2017 and provide fresh bullish impetus for the greenback's well-established strong bullish trend. A follow through buying interest above 1.2300 handle, and a subsequent break through 1.2335-40 resistance area, is likely to trigger a short-covering rally towards 1.2400 handle ahead of 50-day SMA resistance near 1.2425 region.On the flip side, weakness below 1.2235 immediate support might continue to take support near 1.2200 handle, which if broken decisively is likely to accelerate the slide towards 1.2160-55 intermediate support, en-route 1.2130-25 horizontal support.

USD/JPY slips into negative territory

The USD/JPY pair once again failed to retain its strength above 118.00 handle for the second consecutive day and has now erased daily gains to drift into negative territory. Currently trading around 117.60 region, testing session lows, a mild cautious mood around European equity markets is pointing to slight deterioration in investors risk appetite and lending some support to the Japanese Yen's safe-haven appeal. Moreover, retracing US Treasury bond yields across the board is also seen weighing on the US Dollar and contributing to the pair's retracement from session peak. From technical perspective, the pair has repeated failed to witness a follow through action beyond 118.00 handle. However, the recent corrective slide turned out to be short-lived, clearly suggesting that the pair might have entered a near-term consolidation phase. Hence, focus would remain on this week's important US macro releases, including the key monthly jobs report, which would help investors determine the next leg of directional move for the major. With the scheduled release of minutes from the December policy meeting, when the central bank finally decided to hike rates for the first time in 12-months, the Fed would be back on center on Wednesday. The minutes would be looked upon for fresh insight over the Fed's monetary policy outlook and should provide fresh impetus or the greenback's well-established strong up-trend. A follow through retracement below 117.50 immediate support is likely to accelerate the slide towards 117.20 intermediate support ahead of 117.00 round figure mark. On the upside, 118.00 handle now seems to have emerged as immediate hurdle and on a sustained move back above this important resistance, the pair could make a fresh attempt to head back towards multi-month highs resistance near 118.60-65 region.

USD/CHF keeps red below 1.0300 handle ahead of Fed minutes

After yesterday's sharp up-swing to three-week peak and a subsequent retracement, the USD/CHF pair traded with mild weakness below 1.0300 handle and is now headed back to the lower end of daily trading range. Currently trading just above mid-1.0200s, the US Dollar pull-back from Wednesday's 14-year high has been the key factor weighing on the major. Adding to this, bearish trading sentiment surrounding European equities is further diverting some safe-haven flows towards the Swiss Franc and is also contributing to the pair offered tone on Wednesday. Investors on Wednesday keenly await for the minutes from the Fed's most recent meeting on December 13-14, which would provide fresh insight over the pact of interest-rate hikes in 2017 and might trigger the next leg of directional move for the major. A follow through selling pressure below 1.0250-45 area (session low) seems to drag the pair back towards 1.0220 horizontal support, which if broken would expose sub-1.0200 level support near 1.0175 level. On the upside, momentum above 1.0285 immediate hurdle now seems to confront resistance near 1.0300 handle above which a fresh bout of buying interest is likely to lift the pair back towards 1.0335 (yesterday's high) en-route multi-year highs resistance near 1.0344 (Dec. 15 high).

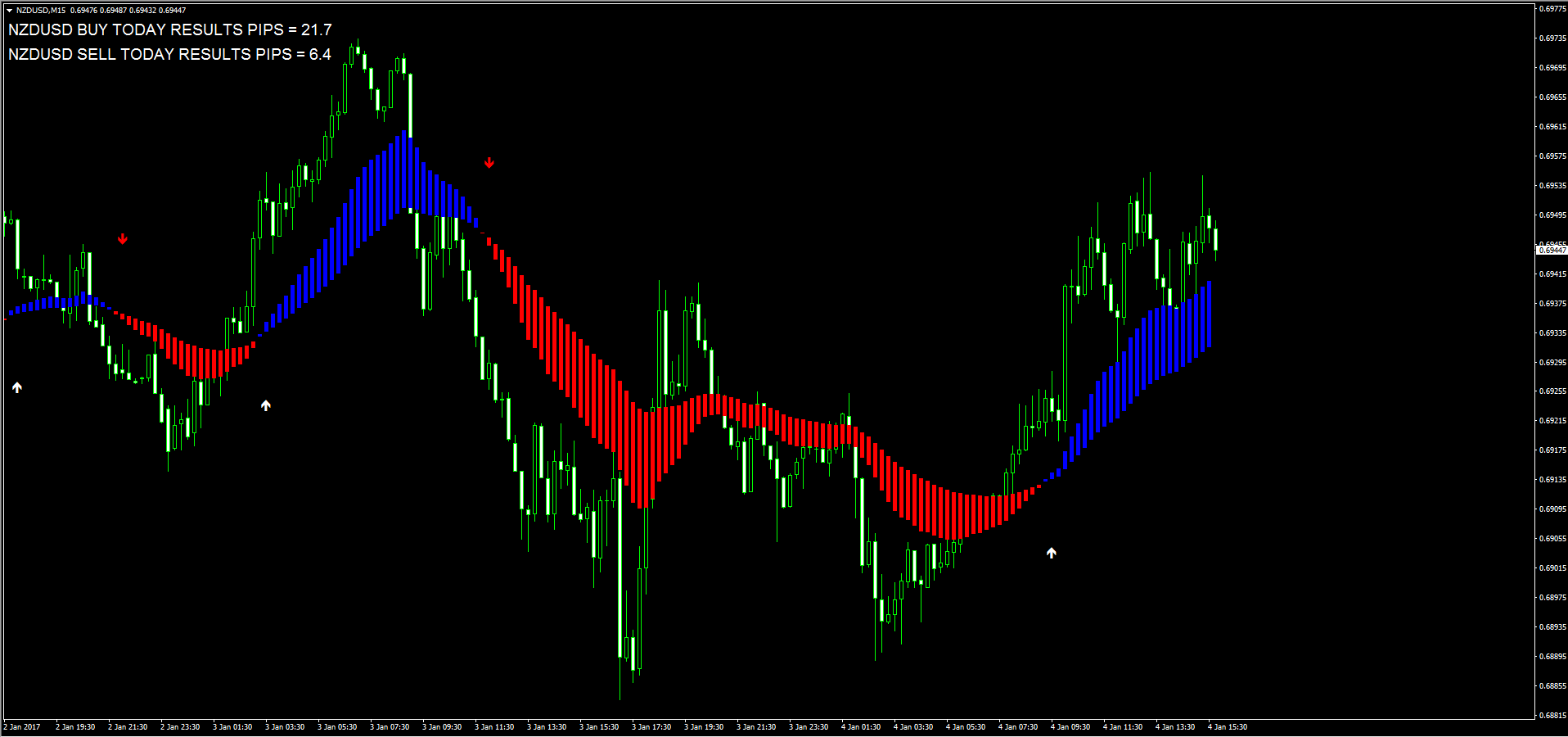

NZD/USD extends recovery to session high near 0.6950

After an initial dip below 0.6900 handle, the NZD/USD pair caught fresh bids and gained over 60-pips from session low.Currently trading around 0.6950 region, broad based US Dollar retracement from 14-year peak seems to have negated the bearish pressure in wake of Wednesday's dismal GDT price index. Moreover, upbeat sentiment surrounding commodity space also collaborated to the pair's recovery from sub-0.6900 level. Investors on Wednesday keenly await for the release of minutes from the Federal Reserve?s most recent meeting, when the central bank decided to raise interest rates for the first time since Dec. 2015 and forecasted three rate-hikes for 2017. Should the minutes reaffirm projected rate-hike actions, it is likely to attract fresh selling pressure around higher-yielding currencies - like the Kiwi. A follow through buying interest above 0.6960 resistance has the potential to continue boosting the pair further towards 0.7000 psychological mark ahead of its next major hurdle near 0.7035-40 region. On the flip side, weakness back below 0.6915 immediate support is likely to drag the pair back towards session lows support near 0.6885 region en-route multi-month lows support near 0.6860 region.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.