EUR/USD turns flat amid subdued trading action

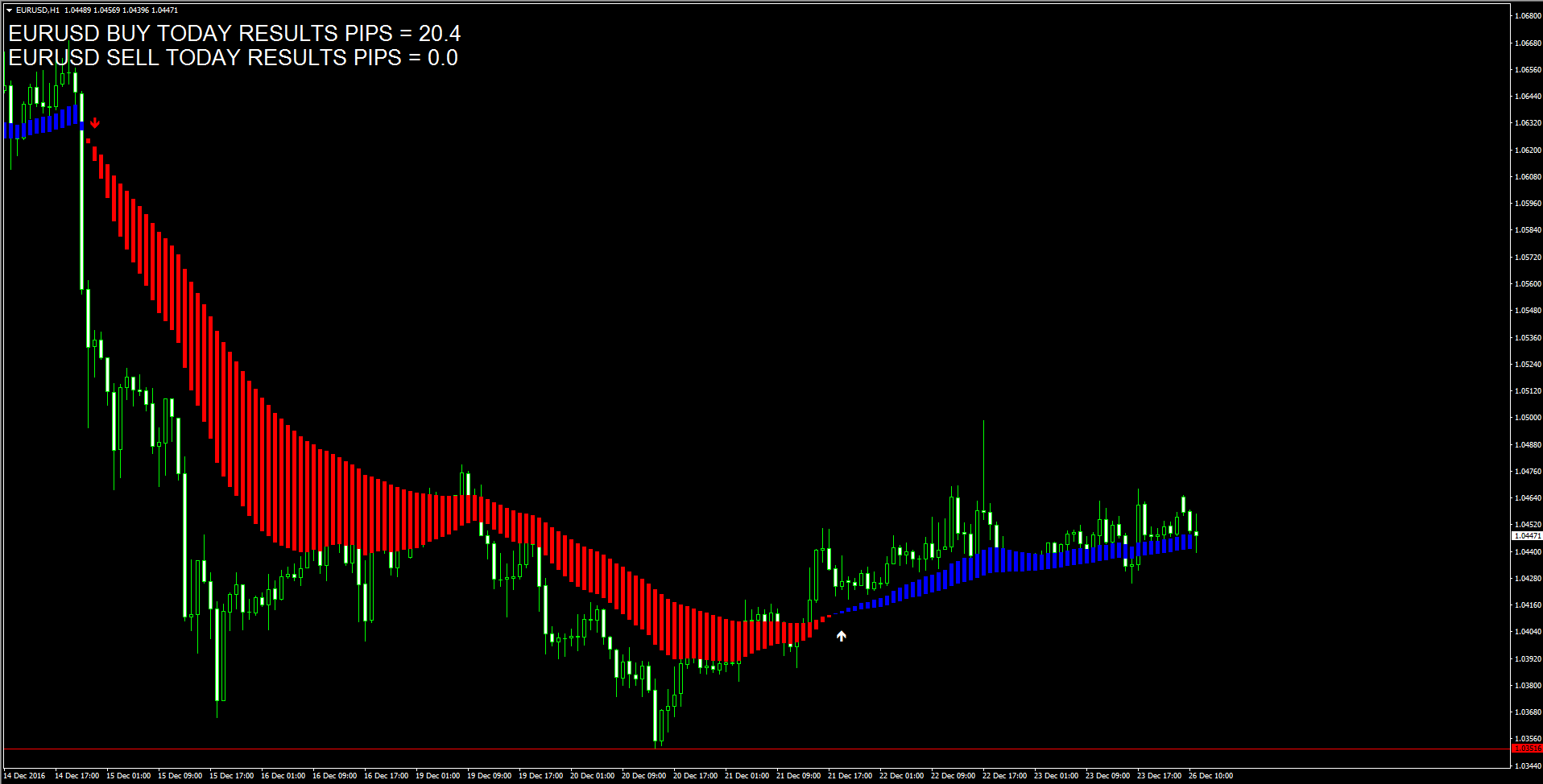

The US Dollar extended its recovery during early NA session, with the EUR/USD pair erasing tepid recovery gains and drifting into negative territory.Currently trading around 1.0430 level, testing session lows, the pair ran through fresh offers after repeatedly failing to decisively break through 1.0465-70 resistance area marking 23.6% Fibonacci retracement level of its post-ECB slide from 1.0839 to 1.0352 - 14-year low touched at the beginning of this week. Also on Thursday, the pair failed to build on to disappointing US income / spending data-led spike to 1.0500 handle and reversed majority of daily gains, albeit settled with moderate strength. The pair's recent price action clearly suggests that the recent leg of recovery was solely led by unwinding of short positions from near-term oversold conditions and ahead of holiday season, while the pair's strong bearish trend remains intact. Next in focus would be the release of new home sales and revised UoM consumer sentiment index from the US. On a sustained weakness below session low support near 1.0430 area is likely to pave way for additional slide towards 1.0400 handle, which if broken might continue dragging the pair initially towards retesting multi-year lows support near 1.0350 level and eventually towards 2003 yearly lows support near 1.0335 level. On the flip side, 1.0450-55 area now becomes immediate strong hurdle above which the pair is likely to make a fresh attempt towards reclaiming 1.0500 psychological mark.

GBP/USD hovers near 2-month lows, headed for third weekly decline

GBP/USD extended losses on Friday and fell to fresh 7-week lows as the pound failed to benefit from decent UK GDP data.GBP/USD fell for a fifth straight day and is on track to post its third weekly loss in a row, despite a softer greenback seen over the last days. GBP/USD dropped to its lowest level since Nov 2 at 1.2227, and it was last trading at 1.2255, down 0.24% on the day.The UK Q3 GDP final came in at 0.6% QoQ versus 0.5% expected and following a 0.5% increase in Q2. Meanwhile,the current account deficit shrunk in Q3, coming in at ?-25.5bln versus ?-28.3bln expected.In the US data showed the University of Michigan consumer sentiment index rose to 98.2 in December from 98.0 previous and expected while US new home sales increased 5.2% in November to a seasonally adjusted annual rate of 592,000 and above 575,000 expected.In terms of technical levels, next supports are seen at 1.2227 (Dec 23 low), 1.2204/00 (Nov 1 low/psychological level) and 1.2081 (Oct 25 low). On the other hand, resistances 1.2297/1.2300 (Dec 23 high/psychological level), 1.2377 (Dec 22 high) and 1.2419 (50-day SMA).

USD/JPY drops toward 117.00 on a quiet session

USD/JPY dropped to 117.15, reaching a fresh 2-day low. The pair was trading sideways, in a range between 117.27 and 117.50 before breaking to the downside. Currently, USD/JPY is trading at 117.30, 25 pips below yesterday?s closing price, is headed toward a modest weekly lost. The Japanese yen is among the top performers in the currency market, on a quiet, low volume session. In Wall Street, equity prices are flat with the Dow Jones hovering modestly above 19,900. The pair is lower on Friday, despite better-than-expected US economic data: new home sales rose 5.2% in November (vs 2.1% of market consensus) and the Michigan Consumer Sentiment index rose from 98.0 to 98.2. To the upside resistance levels might be located at 117.50 (European session high), 117.85/90 (Dec 22 high) and 118.25 (Dec 20 high). On the opposite direction, support could be seen at 117.15 (daily low), 117.00 (psychological) and 116.55.

EUR/GBP extends weekly gains above 0.8500

The euro is about to post the strongest weekly gain since early October against the pound. EUR/GBP rose every day of the week, and on Friday extended the rally above 0.8500. The pair peaked at 0.8538, the highest level in two weeks and the pulled back modestly. It was trading at 0.8530, up 0.45% for the day. The pound remains weak in the market and is among the worst performers of the week. On Friday, not even better-than-expected economic data from the United Kingdom helped the currency. The final estimation of Q3 GDP showed an expansion at 0.6% q/q against the 0.5% expected; it represented an upward revision from the previous reading of 0.5%. The current account deficit dropped during the third quarter, coming in at ?-25.5bln versus the ?-28.3bln expected. Concerns about the impact of Brexit over the UK economy continue to affect the pound. The formal exit from the European Union will start in 2017, but the process it likely to take years. The euro holds a bullish tone that could remain intact as long as price holds above a short-term uptrend line that currently stands around 0.8435/40. A break lower, could remove the positive momentum out of the euro. Now the pair is facing resistance around 0.8540. Above here, the next barrier, is seen at 0.8565/70, a consolidation above could open the doors to more gain. While to the downside, before the downtrend line, EUR/GBP could find support at 0.8510 (Dec 22 high) and 0.8450 (Dec 19 high).

USD/CAD surges to five week high on dismal Canadian GDP

The USD/CAD pair caught fresh bids and built on to its momentum above 1.3500 handle to touch the highest level since Nov. 18 after disappointing Canadian GDP print. Currently trading around five-week high level of 1.3540, a big miss from monthly Canadian GDP print for October, released just a while ago, added on to Thursday's dismal CPI reading and was seen weighing heavily on the Canadian Dollar. In fact, the monthly GDP print came-in to show a contraction of 0.3%, falling below estimates pointing to a flat reading and worse than 0.3% growth recorded in the previous month. Moreover, a weaker sentiment surrounding oil markets, with WTI crude oil trading with losses in excess of 1%, is further driving flows away from the commodity-linked currency - Loonie. Next on tap would be US economic data that includes - new home sales data and revised UoM consumer sentiment index.A follow through buying interest above mid-1.3400s might continue to boost the pair further towards multi-month highs resistance near 1.3590 area (touched in Nov.) before the pair eventually breaks through 1.3600 handle and head towards testing its next major hurdle near 1.3650-55 horizontal zone.On the downside, 1.3515-10 area, closely followed by 1.3500 psychological mark, now becomes immediate support to defend. Failure to hold this immediate support is likely to trigger a profit-taking slide below 1.3480 horizontal support, towards its next support near 1.3420 level.

Gold consolidates above $1130, flat for the week

Gold gained momentum during Friday?s American session and rose to $1135 but pulled back afterward, approaching $1130. It was marginally higher for the day and flat for the week. On a quiet session, the metal continued to move on a consolidation mode, near the lowest level in months. The stabilization in gold follows seven weeks in a row with declines. Since US elections the value of the ounce fell more than $150. The bias continues to favor the downside as no major signs of correction area seen. Price remains within a bearish channel, with a key dynamic resistance now at $1140. A break higher could lead to a bullish correction and remove some downside potential. On the downside the immediate support is seen at $1125; while above here price action is likely to remain limited. A consolidation under $1125, could clear the way for a test of $1100. Actual market conditions ahead of holidays might help keep price moves in ranges.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.