EUR/USD broader downtrend remains resolutely intact - Scotiabank

Analysts at Scotiabank note that EUR/USD short-term technical perspective looks neutral to bearish as despite yesterday?s recovery, the bigger picture suggests the broader downtrend remains resolutely intact.?EURUSD is little changed on the day. Germany delivered a surprisingly strong ZEW survey today, suggesting investors are full of the holiday spirit. The current conditions index rose to 63.5 (59.0 expected), perhaps reflecting the ECB?s largesse in extending its QE programme last week.Expectations were modestly disappointing, however, remaining unchanged over November at 13.8.?EURUSD short-term technicals: neutral/bearish It is tempting to describe the short-term outlook here as ?bullish, bearish and/or neutral?; EURUSD had a solid day yesterday, rising strongly (bullish outside range day) from a level (low 1.05 area) that has held a number of tests over the past month. That should be important. But the bigger picture suggests the broader downtrend remains resolutely intact and short-term prospects only really improve obviously for the EUR above 1.0840/50 from here.??Intraday price action has stalled three times around 1.0650 in the past 24 hours and the market looks soft again now. We think the EUR remains vulnerable to a push under 1.05 and a drop towards 1.01.?

GBP/USD shrug-off upbeat UK jobs data, hits fresh session low

Having failed to benefit from better-than-expected UK jobs data, the GBP/USD pair ran through some offers and has now dropped to a fresh session low.Currently trading around mid-1.2600s, having posted a session low at 1.2635, the pair failed to attract any fresh buying interest despite of today's upbeat UK employment details showing lower-than-expected rise in Claimant Counts (2.4K vs. 5.5K expected) and better-than-expected average weekly earnings growth of 2.5%. The unemployment rate for three months to October remained unchanged at 4.8%.Today's stronger wage growth data added on to Tuesday's upbeat print for UK consumer inflation, as measured by CPI, but failed to provide any fresh traction for the British Pound as investors opt to remain on the sidelines ahead of this week's key event risks.This week's major events, which could have a wider effect on the pair's near-term trajectory, includes - monetary policy decisions from the US and UK. The US Federal Reserve will announce its monetary policy decision on Wednesday, while BOE is scheduled on Thursday. In the meantime, monthly retail sales data and PPI print from the US might provide some impetus for the pair during early NA session. "The pair has met selling interest earlier on the day at 1.2685, the 23.6% retracement of the 1.2394/1.2774 rally, still up on the week. The technical stance is still bullish, despite the lack of upward momentum, with the Pound overall strong, which means that the upcoming FED decision could have a limited effect on the pair."She further writes, "Below the 38.2% retracement of the same rally, at 1.2625, the pair will likely fall to the 1.2550 region, whilst below this last, there's room to test a daily ascendant trend line coming from December low, today at 1.2510. Above 1.2700 on the other hand, the pair can run up to the 1.2780/90 region on a disappointing FED, while an extension beyond 1.2800 will point to a steady advance up to the 1.2840/60 region."

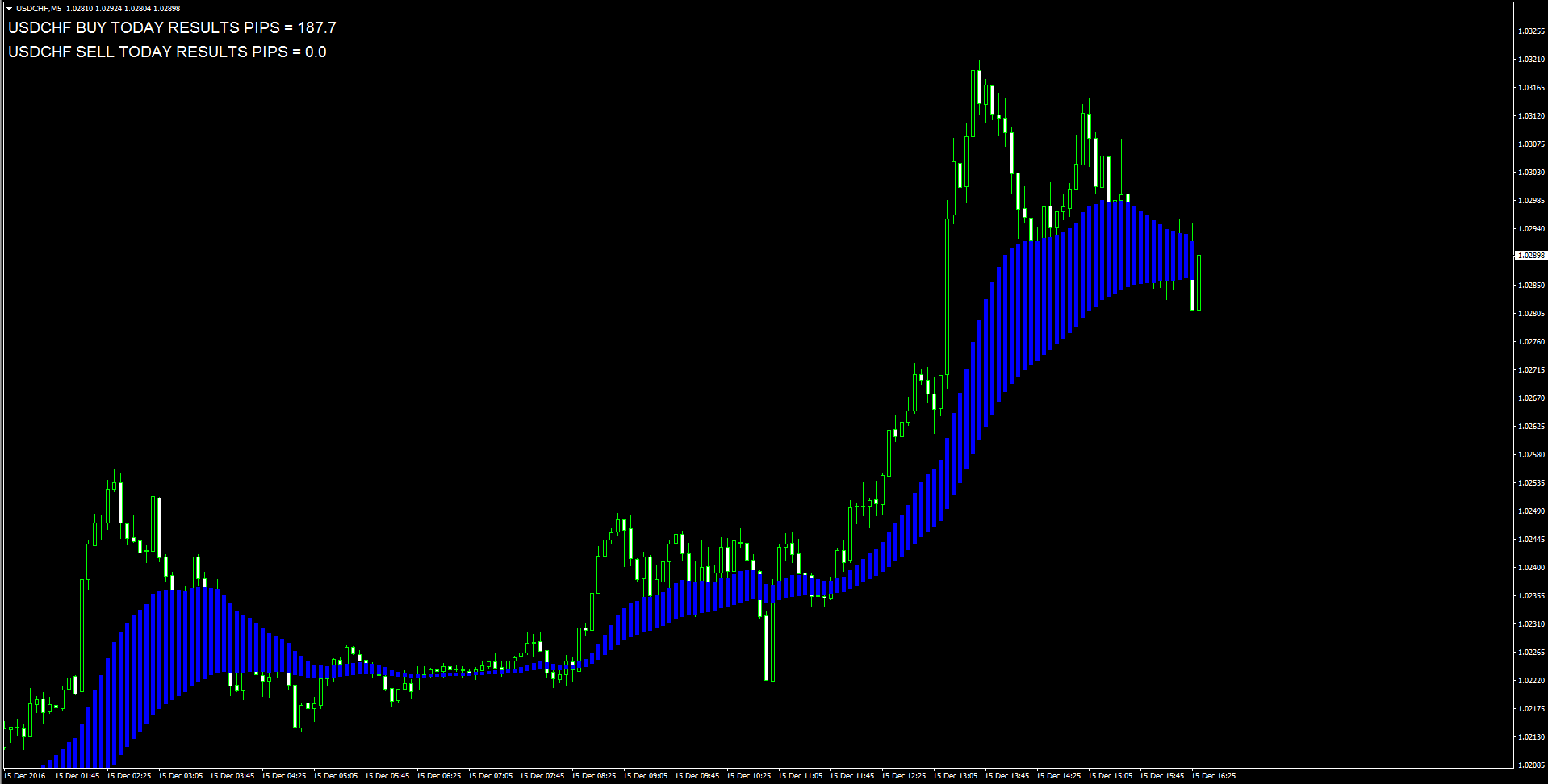

USD/CHF on the verge of breaking below 1.0100 handle

The USD/CHF pair remained well offered for the third consecutive day and is now headed back towards 1.0100 important psychological mark support.The prevalent cautious sentiment, as depicted the weakness around European equity market, is driving safe-haven demand for the Swiss Franc and is exerting some selling pressure around the major. Moreover, subdued US Dollar price-action, as investors anxiously await for an update over the Federal Reserve's monetary policy outlook for 2017, has also failed to attract any buying interest and lend support to the pair's ongoing corrective slide from 10-month highs touched last week.From technical perspective, the pair has repeatedly failed to conquer 1.0200 handle. Hence, a sustained weakness below 1.0100 mark might confirm rejection and turn the pair vulnerable to continue with its corrective slide further in the near-term.Ahead of the much awaited FOMC rate-decision, traders would confront coupled of important US macro data - monthly retail sales and PPI, during early NA session and would be looked upon for some immediate respite. A convincing break below 1.0100 handle is likely to accelerate the slide immediately towards 1.0060-55 horizontal support before the pair eventually drops to retest parity mark. On the upside, recovery momentum above session peak resistance near 1.0125 region seems to lift the pair towards 1.0160-65 horizontal resistance above which the pair seems to make a fresh attempt to conquer 1.0200 handle.

NZD/USD jumps closer to Tuesday?s 4-week highs

After spending majority of the European trading session around 100-day SMA region, the NZD/USD pair caught fresh bids and has now moved back closer to yesterday's 4-week high.Currently trading around 0.7225-30 band, the pair extended its winning streak for the third consecutive session and now seems to have confirmed a break-out above 0.7200 handle, coinciding with 100-day SMA important resistance. The US Dollar remained on the back-foot, amid cautious trade ahead of the Fed interest-rate decision, and has been a key factor supporting the pair's up-move on Wednesday. Meanwhile, possibilities of shorts covering their positions, heading into the big event risk, might have also contributed to the pair strong up-move in the past couple of hours. Ahead of the much anticipated Fed monetary policy decision, the pair is unlikely to react to the US macro data that includes - retail sales data and PPI, slated for release during early NA session. A follow through buying interest above 0.7230 level should trigger a fresh bout of short-covering and lift the pair immediately towards 0.7260-65 resistance area ahead of 0.7300 handle. Alternatively, reversal from current levels, and a subsequent break back below 0.7200 handle (100-day SMA), would negate possibilities of any further up-move and drag the pair towards 0.7175-70 area, en-route 50-day SMA support near 0.7150 region.

USD/CAD falls below 1.3100, hits 2-month lows

USD/CAD broke below the 1.31 mark and slid to fresh 2-month lows during the American session, as commodity currencies continue to outperform ahead of the FOMC decision.The loonie has been underpinned by higher oil prices on Wednesday as the IEA forecasts that global crude inventories will fall 600th bpd in the next 6 months, following the OPEC/NOPEC agreements.USD/CAD fell through previous weekly lows and hit its lowest level since mid October at 1.3092 in recent dealings. At time of writing, USD/CAD is trading at 1.3095, down 0.26% on the day.However, investors might refrain from adding positions hours ahead of the Federal Reserve decision on monetary policy.As for technical levels, immediate supports are seen at 1.3071 (200-day SMA) and 1.3005 (Oct 19 low). On the flip side, resistances could be found at 1.3140 (Dec 14 & 13 highs), 1.3160 (Dec 12 high) and 1.3190 (100-day SMA).

US December FOMC Preview: 4 major banks expectations

We are closing into the FOMC?s December policy meet decision and as the clocks tick closer to the decision timing, following are the expectations as forecasted by the economists and researchers of 10 major banks along with some thoughts on the future course of Fed?s action.Most economists and analysts expect the FOMC will raise the federal funds rate target to 0.50-0.75% at the conclusion of the today?s meeting as the incoming data since the last meeting has been sufficiently positive for the Committee to conclude that the case for rate hike has been finally met. In addition, most of the banks expect that the Committee will not adjust the path of rates materially as the Committee and Chair Yellen are likely to be cautious, while emphasizing data dependency and reserving judgement on the impact of coming fiscal measures until more details and certainty are available next year.

Goldman Sachs

In line with market pricing, we expect the FOMC to raise the federal funds rate by 25bp. That said, we also think that Chair Yellen will continue to emphasize that monetary policy is not on a pre-set course and that the data will dictate the future path of interest rates. Guidance from the meeting, the Summary of Economic Projections, and Chair Yellen?s testimony are likely to repeat the committee?s existing view that the pace of rate hikes will be gradual. In the Summary of Economic Projections (SEP), we look for: (1) modest upward revisions to GDP growth and lower unemployment rate projections for 2016 and 2017; (2) a one-tenth increase in core PCE for 2016 and 2017; and (3) unchanged median fed funds rate projections for 2017 and beyond.

Nomura

In line with market expectations, we expect the FOMC will raise the federal funds rate target to 0.50-0.75% at the conclusion of the 13-14 December meeting. We think that the incoming data since the last meeting has been sufficiently positive for the Committee to conclude that the case for rate hike has been finally met. On the policy statement, we expect the paragraph on current economic conditions to point to continued growth. Additionally, we expect the Committee to highlight two notable developments a sharp drop in the unemployment rate and a pickup in market-based measures of inflation compensation in the statement. On the economic outlook, we expect no substantive changes, although the Committee may acknowledge a shift in the balance of risks to the positive side given the potential fiscal stimulus that will likely be realized under a Republican-led Congress and a Trump White House. In addition, we will receive a new set of forecasts from the FOMC participants. We think that the median growth forecast in 2016 will be revised up and the median unemployment rate will be revised down. On inflation, given the recent moves in energy prices, we think PCE headline inflation forecast for 2016 will be revised up slightly higher but we think that the core inflation forecast will remain unchanged. Our base scenario is that FOMC participants will not change their outlook for 2017 and beyond as we do not think the Committee will incorporate the possibility of fiscal expansion. On the dots, as the data have come in broadly in line with market expectations, we do not think that the Committee will adjust the path of rates materially. Last, Chair Yellen will hold a press conference after the conclusion of the two-day policy meeting. We will likely hear the reasons that led the Committee to raise rates. We will also listen for any clues on how the FOMC may change its outlook in response to the major fiscal stimulus that will likely be enacted next year.

BNPP

We expect a 25bp increase in the Fed funds target range to 0.50-0.75%. The elephant in the press conference room will be how the Fed will respond to changes in the fiscal outlook and its effects on the economy, which remain highly uncertain. We expect a lot of talk about data dependence and maybe some discussion of scenarios, but little new guidance beyond what is already in the Fed?s projections. Fed Chair Yellen will be pressed by the media, however, and it will be difficult for her not to say that easier fiscal conditions mean tighter monetary ones.

Natixis

Fed is widely expected to hike the Fed funds rate by 25bps (to 0.50%-0.75%) at the FOMC meeting. In the statement, the Fed should confirm the recent strengthening in economic activity and the improvement on the labor market (decline in unemployment rate) while continuing to emphasize its cautious approach regarding the tightening cycle. In the summary of economic projections (SEP), the Fed is likely to revise the 2016 growth forecasts downward from the September level. Growth forecasts for coming years could be revised downwar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.