EUR/USD more optimistic, bounces to 1.0870

The shared currency remains entrenched in the negative territory at the end of the week, with EUR/USD now coming up from earlier lows in the mid-1.0800s.The selling bias around EUR stays unabated this week, briefly sending spot to test 2-week lows near the ley support at 1.0850, level last seen in late October.On the opposite side, the greenback is extending its march north always backed by the solid momentum in US yields and rising expectations of a Fed?s move by year-end. On the latter, CME Group?s FedWatch tool now sees the probability of higher rates in December at above 71% based on the Fed Funds futures prices.In the US data space, November?s flash Consumer Sentiment tracked by the Reuters/Michigan index is due along with a speech by FOMC?s S.Fischer (permanent voter, hawkish).Previously in Germany, October?s inflation figures have matched preliminary readings although market participants have largely bypassed the releases.The pair is now retreating 0.19% at 1.0875 facing the next support at 1.0854 (low Nov.11) followed by 1.0848 (low Oct.25) and finally 1.0820 (low Mar.10). On the other hand, a breakout of 1.0958 (high Nov.10) would target 1.0974 (20-day sma) en route to 1.1029 (23.6% Fibo of the May-October drop).

GBP/USD in 5-week tops above 1.2600

The upside momentum around the Sterling remains intact so far this week, taking GBP/USD to fresh multi-week tops above the 1.2600 handle.Spot is on its way to close its second consecutive week with gains so far today, including fresh 5-week tops above 1.2650, the highest level since the GBP?s ?flash crash? in early October. Cable is also deriving support from the persistent drop in EUR/GBP, as the selling pressure around the single currency is everything but abated, particularly following Trump?s victory in the US elections.GBP appears to have derived additional support after elected US President D.Trump advocated for a continuation of firm trade conditions between the US and the UK.Later in the session, US advanced Reuters/Michigan index for the month of November is due followed by the speech by FOMC?s S.Fischer (permanent voter, hawkish).As of writing the pair is up 0.60% at 1.2624 facing the next resistance at 1.2718 (55-day sma) ahead of 1.2910 (100-day sma) and finally 1.2796 (low Jul.6). On the other hand, a break below 1.2349 (low Nov.9) would open the door to 1.2320 (20-day sma) and finally 1.2081 (low Oct.25).

USD/JPY off-highs, but holds above daily pivot

USD/JPY failed once again near 107 handle and fell sharply to test daily lows, although the bulls were once again rescued by a strong support placed near the daily pivot.The USD/JPY pair keeps its bearish momentum intact, with every attempt to 107 handle rejected amid subdued demand for the US dollar, as dust settles over the US elections aftermath.However, the losses remain capped amid higher treasury yields as markets continue to price-in a Dec rate hike, despite an unexpected Trump-win at the US presidential elections race. The major is last seen exchanging hands around 106.40, still down -0.40%.The major may get influenced by US consumer sentiment and Fed speak due later today, amid thin trading as the North American markets remain closed in observance of a National Holiday.In terms of technicals , the immediate resistance is located at 106.72 (Jul 24 high). A break above the last, the major could test 106.95 (multi-month high) and 107.48 (Jul highs) beyond the last. While to the downside, the immediate support is seen at 106.25 (daily pivot & low) next at 106.00 (round figure) and below that at 105.26 (200-DMA).

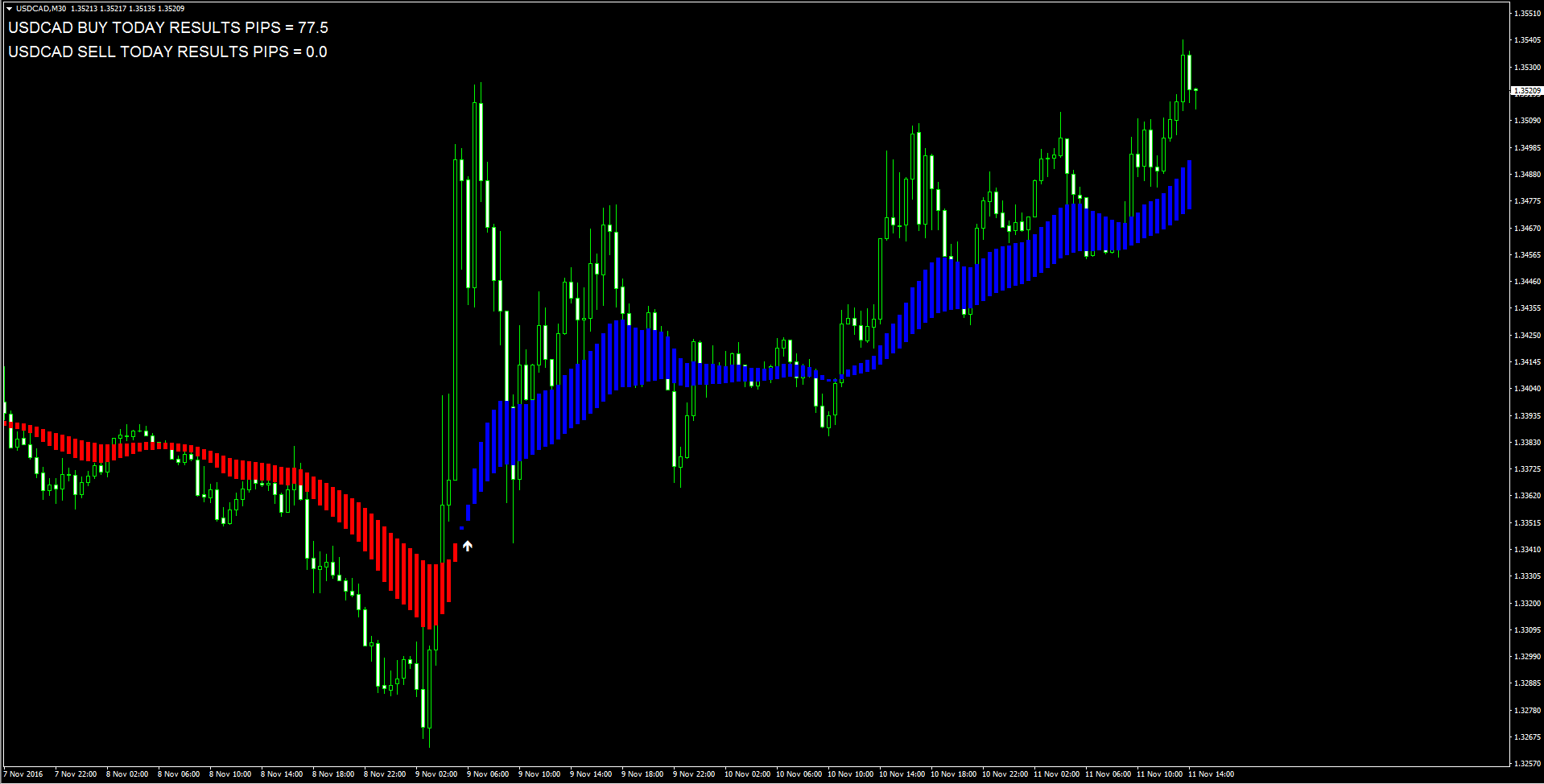

USD/CAD reaches fresh 8-month highs

USD/CAD extended gains to fresh 8-month highs on Friday as the greenback retains a firm tone amid expectations that any fiscal stimulus implemented by Trump administration would lead to a faster pace of monetary tightening.USD/CAD broke above previous weekly highs and stretched to a peak of 1.3541 in recent dealings. A drop in oil prices also helped to push the pair higher. At time of writing, USD/CAD is trading at 1.3525, recording a 0.43% daily gain.On the data front, the Michigan consumer sentiment index is due, while speeches from Fed?s Fischer and BoC?s Poloz are expected.In terms of technical levels, next resistances are seen at 1.3586 (Feb 29 high), 1.3600 (psychological level) and 1.3796 (Feb 4 low). On the flip side, supports could be faced at 1.3405 (10-day SMA), 1.3336 (20-day SMA) and 1.3263 (Nov 9 low).

AUD/USD upside faltered (again) at 0.7735/80 Commerzbank

Karen Jones, Head of FICC Technical Analysis at Commerzbank, noted the upside in the Aussie dollar has run out of steam in the 0.7735/80 band.?The AUD/USD continues to falter .7735/80 ? this has been the scene of numerous failures since August and it has sold off to the 2016 uptrend is located at .7560 and a close below here is needed to undermine the range bound trading which has dominated the chart for the past 3 months?.?Failure here targets the September low at .7443 and the 200 day moving average at .7506. This remains a critical break down point to the .7146 May low?.?The top of the range is .7755/78, the August and September and recent highs. Above .7755 would introduce scope to the .7836 April high and this remains viable?

Trump rhetoric to determine fate of EM FX - SocGen

Research Team at Societe Generale, suggests that the Trump victory would impact EM currencies and primarily that of risk sentiment, international trade, and geopolitical security, and secondarily through expectations of US interest rates and local domestic implications.?1st order reaction: Sustained weakness. Looking ahead, we anticipate two phases / orders of reaction for EM markets. Paralleling the aftermath of the surprise UK referendum Brexit vote, in this case, the first order of reaction is likely to be dominated by risk aversion. We expect the sell-off in MXN to continue, with USD-MXN possibly reaching 23.0 over the near term. High-yielding EM currencies are likewise expected to depreciate (e.g. ZAR, BRL, IDR), along with currencies of countries whose security benefit from US involvement (e.g. KRW, TRY). Much depends on the tenor of Trump?s comments over the coming days with respect to his election promises on immigration, trade, and foreign policy.??2nd order reaction: EM FX stabilizes and could enter a temporary relief rally phase. Post the initial phase of severe market risk aversion, which may last for several days or more, investors are likely to refocus on the medium-term questions of global monetary policy. Our SG Economics team believes that the Trump presidency is likely to cause postponement of the anticipated December FOMC interest rate hike, and may also delay ECB tapering. The market is likely to lower the assigned probability of Fed rate hikes over the coming days. In an extended environment of accommodative monetary policy from developed markets, most EM currencies (apart from MXN) will have less downside and could enter a relief rally phase if global growth conditions remain favourable.??Higher risk premium and USD-EM are biased higher. A Trump victory has introduced higher uncertainty and risk premium into policy-making ? through channels including trade and geopolitics ? which will likely result in weaker EM currencies than otherwise. Our base case scenario remains for USD-EM to head gradually higher over the medium term, with selective high yielders (BRL, RUB, INR, IDR) outperforming low yielders. On a regional basis, we continue to believe that Asian EM FX will underperform currencies of other regions.?

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.