EUR/USD inter-markets: waiting for the dust to settle

EUR/USD has fully reverted the earlier test of the 1.1300 region, turning negative for the day and on its way to challenged the key psychological support at 1.1000 the figure.In the meantime, and after Donald Trump has become the 45th US President, the greenback is extending the bounce off daily lows and prompting the risk-associated assets to surrender initial gains.German money markets are showing yields navigating in the red territory, while their US peers remain on the rise, hence sustaining the better momentum in the buck. Furthermore, CME Group?s FedWatch tool is now pointing to a probability of a rate hike by the Fed at nearly 67% in December, based on Fed Funds futures prices.With the US elections already in the rear-view mirror, it is expected that market participants shift their attention to the US monetary policy as the main driver of the pair?s price action via USD-dynamics.As markets are returning to normalcy following the unexpected victory by billionaire D.Trump, EUR/USD faces increasing risks of re-visiting daily lows at 1.0990, ahead of the 1.0950 area, or July low. An acceleration of the downside pressure could pave the way for a test of post-Brexit low in the 1.0900 neighbourhood and then the key area at 1.0820, March low.

GBP/USD recovery stalled near 1.2450

The Sterling keeps the buoyancy intact vs. the dollar, although GBP/USD seems to have run out of steam in the mid-1.2400s for the time being.GBP/USD remains bid after TrumpThe pair keeps the erratic performance in line with the rest of the FX universe following the victory of Republican billionaire Donald Trump in the US elections.In fact, spot dropped around 2 cents from the daily spike to the mid-1.2500s, bouncing off 1.2350 to the current levels above the 1.2400 handle while market participants continue to digest the unexpected event.Back to the UK, September?s trade deficit has widened to ?12.70 billion from the previous deficit at ?11.15 billion, at the same time missing forecasts for a ?11.20 billion deficit.As of writing the pair is up 0.26% at 1.2416 facing the next resistance at 1.2559 (high Nov.4) followed by 1.2741 (55-day sma) and then 1.2945 (100-day sma). On the other hand, a break below 1.2288 (20-day sma) would open the door to 1.2086 (low Oct.11) and finally 1.1450 (low post-?flash crash? Oct.7).

USD/JPY takes back some losses, but vulnerable to risk-off rallies

USD/JPY has managed to take back most of its early losses triggered by a risk aversion rally on the back of the US election outcome.Unexpectedly Republican Donald Trump became the 45th elected US president, with its implications for markets and the economy still to be seen. A Trump victory is viewed as negative for financial markets as his policies are source of uncertainty.USD/JPY fell to a 1-month low of 101.18 (matching October?s low) as safe-haven demand benefited the yen, but then the pair turned higher, climbing to the 104.20 area. The pair was last trading at 103.90, still down 1.14% on the day.In terms of technical levels, next resistances could be found at 105.49 (Oct 28 high), 106.00 (psychological level) and 106.60 (Jul 27 high). On the flip side, supports are seen at 102.54 (Nov 3 low), 101.18 (Nov 9/Oct 3 low) and 100.74 (Sep 30 low).

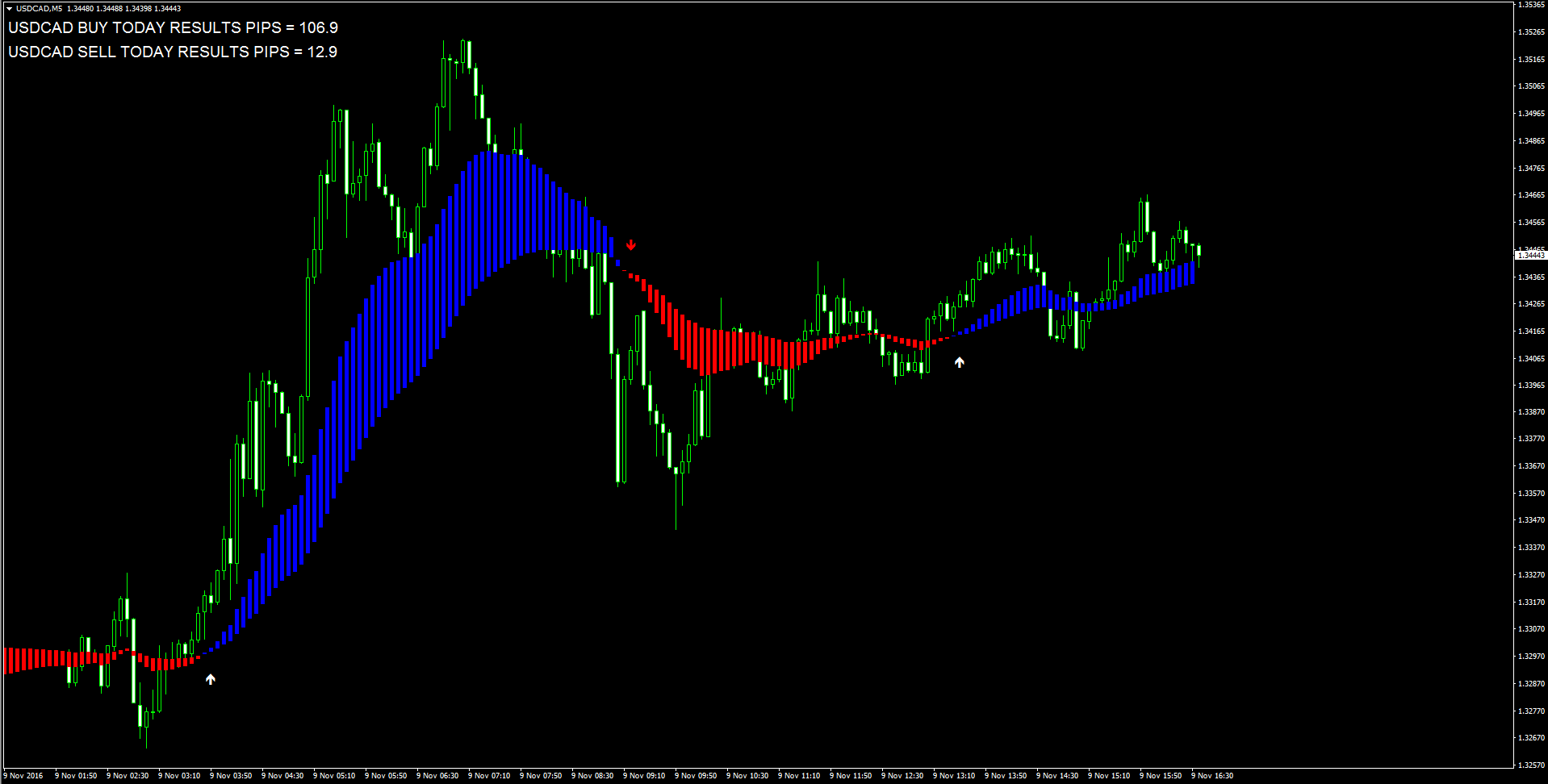

USD/CAD holds onto post-election gains

USD/CAD briefly rose to the 1.3525 area in a bout of risk aversion during the first hours of Trump being elected the 45th US president. However, as with most crosses, USD/CAD retraced its path afterward as markets digest the news.USD/CAD retreated from a peak of 1.3525 to the 1.3340 zone but then reversed. The pair was last trading around 1.3450, still up 1.22% on the day.Oil prices recovered early losses, and WTI managed to regain the $45/bbl mark over the last hours to trade little changed on the day.In terms of technical levels, next supports could now be faced at 1.3285 (Nov 8 low), 1.3263 (Nov 9 low) and 1.3200/1.3194 (psychological level/50-day SMA). On the flip side, resistances line up at 1.3465 (Nov 4 high), 1.3525 (post-election high) and 1.3596 (Feb 29 high).

WTI consolidating below $45.00 ahead of EIA

Crude oil prices have managed to rebound from overnight lows, now sending the West Texas Intermediate to the vicinity of the $45.00 mark per barrel.Prices for the barrel of the American light sweet crude oil have reverted the earlier test of the $43.00 neighbourhood following an initial wave of risk aversion in response to concerns on the likeliness of Trump being elected US President.However, and following the outcome of the US elections, WTI gathered some traction and recovered part of the ground lost along with a generalized pick up in the sentiment around global markets.WTI dropped further on Tuesday after the API reported US crude supplies increased by nearly 4.5 million barrels during last week, adding to the recent massive build in stockpiles and ahead of the EIA weekly report due later in the NA session.At the moment the barrel of WTI is losing 0.53% at $44.74 facing the immediate support at $43.10 (low Nov.9) followed by $42.55 (low Sep.20) and finally $39.19 (low Aug.3). On the flip side, a break above $46.19 (100-day sma) followed by $47.07 (55-day sma) and finally $48.21 (20-day sma).

Gold fades the spike to $1,340 on Trump, stays near $1,300

The ounce troy of the precious metal keeps its daily gains intact on Wednesday, up more than 2% above the $1,300 limestone for the time being.The yellow metal has climbed to fresh 2-month tops near $1,340 earlier in the Asian session accompanying the initial chances that Donald Trump could become the next US President.In fact, the upside in Bullion lost some upside momentum after Trump was proclaimed the 45th US President, although the prevailing ?flight-to-safety? bias remains supportive of a stronger metal.The weaker greenback and the so far generalized offered sentiment around the European markets keep sustaining the demand for the safe haven metal, while the developments post-US elections are poised to driver the mood in the global markets in the very near term.As of writing Gold is gaining 2.35% at $1,304.45 facing the next resistance at $1,338.20 (high Nov.9) ahead of $1,344.45 (high Sep.23) and then $1,350.50 (high Sep.6). On the other hand, a breach of $1,269.67 (low Nov.9) would aim for $1,249.50 (low Oct.5) and finally $1,219.05 (50% Fibo retracement of the 2016 up move).

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.