EUR/USD off session low, still weak below 1.1050

Having dropped to the lowest level since July 27, the EUR/USD pair managed to recover some of its lost ground but struggled to extend the recovery momentum and remained stuck around 1.1050-40 band.The pair on Tuesday confirmed a break down by decisively breaking below an important horizontal support near 1.1125-20 region as increasing bets that the Federal Reserve will raise rates this year. The pair negated Tuesday stronger-than-expected release of Euro-zone ZEW economic sentiment and continued drifting lower for the second straight session. On Wednesday, the greenback, as measured by the overall US Dollar Index, eased from multi-month peaks as investors now look forward to the release of FOMC minutes, later during NY trading session, which if reaffirms market expectations should boost the greenback across the board and turn the pair vulnerable to extend its downslide further in the near-term.From current levels, 1.1080 level seems to act as immediate resistance above which the pair is likely to reclaim 1.1100 handle and aim towards testing an important support, now turned strong resistance, near 1.1125-20 area. On the downside, sustained weakness below 1.1030 (session low) is likely to drag the pair below 1.1000 psychological mark towards testing its next support near 1.0970 horizontal support.

GBP/USD erodes 100-pips, reverts to 1.2200

The retreat in the GBP/USD pair from above 1.23 handle accelerates post-European open, knocking-off the rate back towards 1.22 handle.The selling pressure behind the GBP intensifies in the European session, prompting renewed sell-off in GBP/USD as the GBP traders weigh the latest reports of UK PM May?s parliamentary vote acceptance on Brexit plans and its actual implications. The major is seen last exchanging hands at 1.2236 levels, now recording a +0.92% gain on the day.While negative European equities combined with recent strength in the US dollar against its major rivals, further collaborates to the latest leg lower in the cable. Looking ahead, all eyes remain on the Brexit-related news flow ahead of the FOMC minutes due later in the NA session. The pair finds immediate resistances placed at 1.2325/27 (daily high/ 5-DMA), 1.2400 (round number) and 1.2486 (daily R2). While supports are lined up at 1.2195 (daily pivot) and 1.2106 (daily low) and below that at 1.2086 (Oct 11 low).

USD/CAD headed back to session low, focus on FOMC minutes

The USD/CAD pair maintained its offered tone amid broad based greenback retracement and is now approaching the lower end of daily trading range.Currently hovering around 1.3220 region, the pair reversed part of Tuesday's strong gains led by a stronger US Dollar, which gained traction on increasing prospects of an eventual Fed rate-hike action by the end of this year. Renewed strength in WTI crude oil (now back above $51.00/barrel mark) on Wednesday is benefitting the commodity-linked currency, loonie. This coupled with a minor pull-back in the overall US Dollar Index is exerting some selling pressure around the USD/CAD major. Later during NY trading session, speeches from couple of FOMC members William Dudley and Esther George, along with the release of minutes from FOMC's latest monetary policy meeting will help investors determine the Fed's near-term monetary policy outlook and eventually drive the pair in the near-term.Immediate downside support is pegged around 1.3200 region (200-day SMA), which if broken decisively is likely to drag the pair further towards 1.3060 horizontal support. Meanwhile on the upside, momentum above 1.3240 immediate hurdle could get extended towards session high resistance near 1.3265 region above which the pair seems to aim back towards reclaiming 1.3300 handle.

USD/JPY retreats from highs, eases to 103.50 ahead of FOMC

After climbing to session tops near 103.70 during overnight trade, USD/JPY has now given away some pips and receded to the 103.60/50 band.The pair is looking to stabilize around current levels after recent fresh highs beyond 104.00 the figure following a broad-based USD upside.In the meantime, the selling pressure around the Japanese safe haven seems to persist for the time being, although further JPY weakness remains unlikely in light of the scepticism surrounding the BoJ and its ability to spur inflation expectations.In the data space, preliminary Machine Tool Orders have contracted at an annualized 6.3% in September. On the US data front, the only release of note will be the FOMC minutes from the latest meeting. Market consensus expects the Committee to deliver a somewhat hawkish statement, which could in turn support further the buck.As of writing the pair is down 0.01% at 103.50 and a breakdown of 101.97 (20-day sma) would open the door to 100.07 (low Sep.22) and finally 99.53 (low Aug.16). On the other hand, the next hurdle lines up at 104.17 (high Oct.6) ahead of 104.33 (high Sep.2) and then 107.48 (high Jul.21).

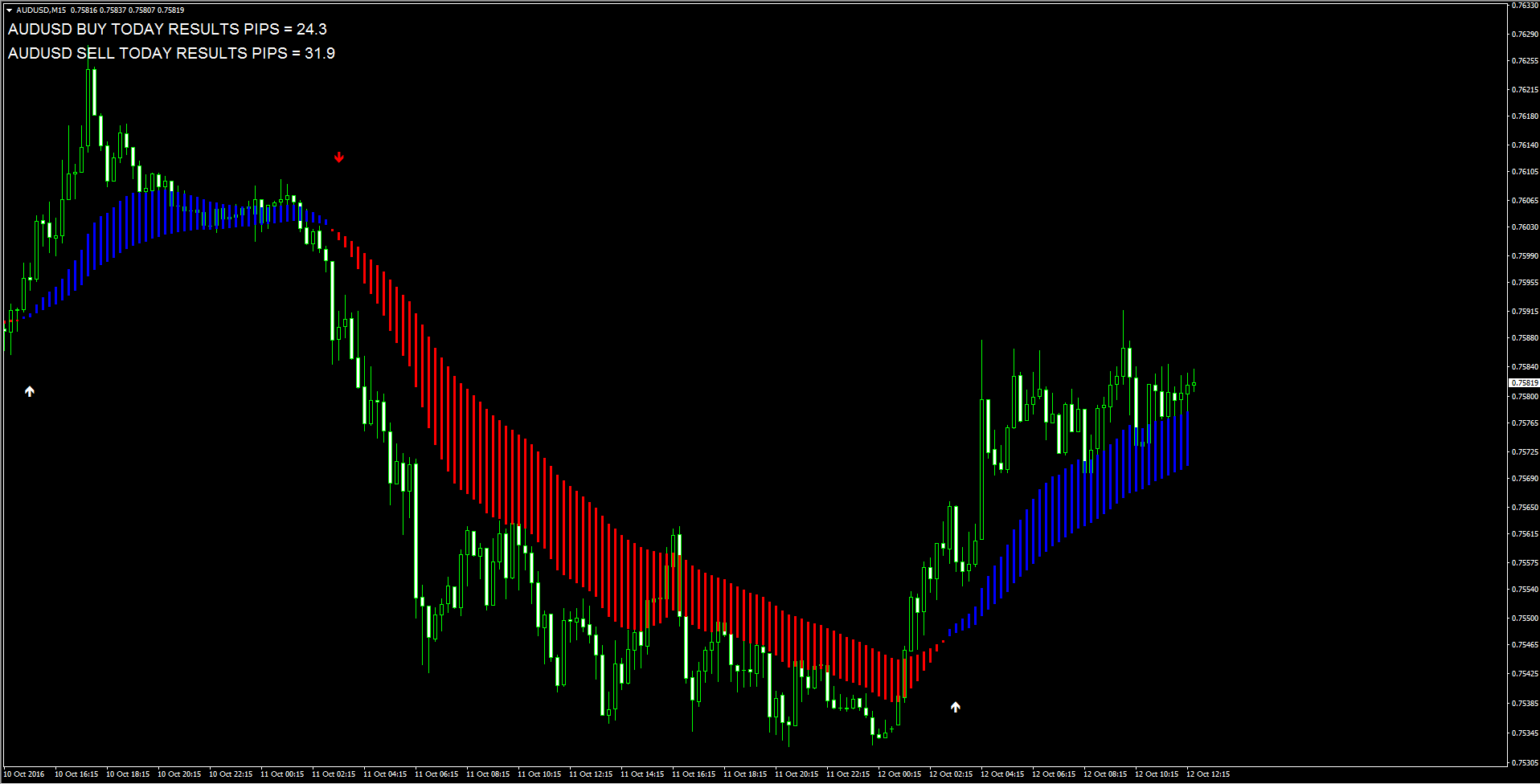

AUD/USD extends recovery from 100-DMA support

The AUD/USD pair staged a sharp recovery from 100-day SMA support and has now reversed majority of the losses recorded in the previous session.Currently trading around 0.7580 region, the pair on Tuesday tested its lowest level since September 20 amid broadly stronger greenback led by increasing bets of an eventual Fed rate-hike action by the end of 2016.Hence, investors will closely scrutinize today's release of minutes from the Federal Reserve's September monetary policy meeting in order to gauge the timing of next Fed rate-hike move with CME group's FedWatch Tool is currently pointing to over 60% probability of such an action in December. Today's release of Westpac Consumer Sentiment index for October, which rose sharply to 1.1% from previous month's 0.3%, provided additional legs to the pair's recovery led by a broad based retracement in the US Dollar, primarily on the back of a sharp rebound in the GBP/USD major. Sustained momentum above 0.7585-90 (session high resistance) seems to assist the pair back towards 50-day SMA support break-point turned resistance near 0.7610 region. A follow through buying interest has the potential to lift the pair further towards 0.7630-35 horizontal resistance area.Meanwhile on the downside, weakness below 0.7550 immediate support is likely to drag the pair back towards 100-day SMA support near 0.7530-25 region below which a fresh leg of depreciating move could drag the pair below 0.7500 psychological mark towards testing its next major support near 0.7465-60 region.

Gold bounces to $1255 on USD retracement, still below 200-DMA

A minor greenback retracement assisted Gold to register a tepid recovery bounce on Wednesday and defend $1250 level support.Currently trading around $1256 level, the precious metal on Tuesday once again failed to register any meaningful recovery and faced rejection at the very important 200-day SMA. The metal subsequently turned lower amid broad based US Dollar strength, which tends to weigh on dollar-denominated commodities - like gold. A sharp slide in the US equity markets failed to boost the yellow metal's safe-haven appeal as increasing prospects of another rate-hike action from the Federal Reserve before the end of this year dented demand for non-yielding commodities and pushed gold price lower.Hence, investors will remain focused on today's release of minutes from FOMC's September meeting, later during NY session, which will determine probability of a December Fed rate-hike action and provide impetus for a fresh leg of directional move in gold prices. Immediate upside resistance remains at 200-day SMA near $1260 region, which if cleared is likely to lift the metal back towards weekly high resistance near $1265 level. A follow through buying interest has the potential to boost the commodity further towards its next major hurdle near $1275-77 region.On the downside, sustained weakness below $1250 immediate support might turn the metal vulnerable to head back towards last week's low support around $1241 level below which the commodity is likely to immediately drift towards $1235 support area.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.