EUR/USD drops further to test 100-DMA

The selling pressure behind the EUR/USD pair intensified post-European session, sending the rate deeper into losses towards 100-DMA support located at 1.1168.Currently, EUR/USD trades -0.28% lower at fresh session lows of 1.1170, moving further away from 1.12 handle. The main currency pair accelerates to the downside as the US dollar extends gains against its major competitors amid a better risk environment, after the European equities open the week on a firmer note. Meanwhile, the US dollar index advances +0.22% to fresh session highs of 96.73, looking to regain 97 handle.The EUR/USD pair ignored auspicious trade data out of the German economy, as the major is likely to remain at the mercy of the USD dynamic, in absence of significant fundamental drivers. While holiday-thinned trades also fail to provide any support to the spot.In terms of technicals, the pair finds the immediate resistance 1.1204/06 (20 & 10-DMA). A break beyond the last, doors will open for a test of 1.1221 (50-DMA) and from there to 1.1250 (psychological level). On the flip side, the immediate support is placed at 1.1150 (psychological levels) below which 1.1100 (round figure) and 1.1104 (2-month low) could be tested.

GBP is trading on a political and structural basis HSBC

David Bloom, Strategist at HSBC, suggests that GBP used to be a relatively simple currency that used to trade on cyclical events and data, but now it has become a political and structural currency. ?This is a recipe for weakness given its twin deficits.The currency is now the de facto official opposition to the government?s policies.The question we have asked hundreds of investors throughout the world is do you want to buy a currency that has massive twin deficits with an unknown political direction and for that risk you can get zero rates? In other words we should have some kind of risk premium which through QE is not showing up in bond markets. It?s the currency that needs to offer this risk premium.To us the FX market is exhibiting an uncanny resemblance to the five stages of grief.First, following the Brexit vote came the denial theories circulated whether a second referendum would have to take place. Second was anger claims the vote was unfair. Third was the bargaining arguments maybe it wouldn?t be that bad, what if the UK followed the Norwegian or Switzerland model. Now the fourth a gloom is prevailing over GBP.It?s become an uncomfortable reality to the market - post the conservative conference that the UK will embark on a ?hard Brexit?. A charm offensive by the Chancellor to try and address these concerns was met by a veritable plunge in the currency, especially after he hinted that he would need to vet any future QE. Suggestions from the UK?s minister for International Trade even suggested the UK should not enter a customs union, the implications being a messy combination of tariffs on goods and a harder challenge in replacing the EU ?passport?. Further uncertainty prevailed following media reports discussing that Carney may not take a second term.Add to that, comments from Eurozone leaders and the picture becomes more complete. Brexit, whether one likes it or not, is a political decision, one we have to respect. However, the argument which is still presented to us - that the UK and EU will resolve their difference and come to an amicable deal appears a little surreal. It is becoming clear that many European countries will come to the negotiation table looking for political damage limitation rather than economic damage limitation. A lose-lose situation is the inevitable outcome.GBP has gone from a cyclical to a political and structural currency. The structure and politics are conducive to a currency that needs to fall to a level that causes balance. That balancing act is and has been in our eyes is still a lot lower than where it is today. We continue to look for GBP-USD at 1.20 by year end and 1.10 by end 2017, taking EUR-GBP to parity.?

USD/CHF making a fresh attempt to conquer 200-DMA

The USD/CHF pair was seen making a fresh attempt to move back above 200-day SMA and aim towards reclaiming 0.9800 handle.Currently trading around 0.9790 region, the pair on Friday ran through fresh offers at 5-week high level of 0.9840 following the release of monthly jobs report that showed the US economy added less-than-expected 156K new jobs in September. The pair subsequently reversed back below 0.9800 handle, once again failing to sustain its move above the very important 200-day SMA and 0.9800 handle. Monday's release of slightly better-than-expected unemployment rate from Switzerland, which ticked-lower to 3.3% in September from previous month?s 3.4%, failed to benefit the Swiss Franc as the greenback remains underpinned by Friday's comments from Cleveland Fed President Loretta Mester that continued fueling speculations of an eventual Fed rate-hike action by the end 2016. Going forward, this week's focus would be on the release of minutes from Fed's latest monetary policy meeting and US monthly retail sales data. Meanwhile on Monday, the pair is likely to witness subdued trading action amid thin liquidity conditions on the back of a US holiday in observance of Columbus Day.Immediate upside resistance is pegged at 0.9800 handle above which the pair is likely to aim back towards 0.9840 (Friday's swing high) before darting towards September monthly high resistance near 0.9885 level.Conversely, weakness below 0.9775-70 (session low support) seems to drag the pair back towards 0.9750 region (100-day SMA support) ahead of 50-day SMA support near 0.9730 region.

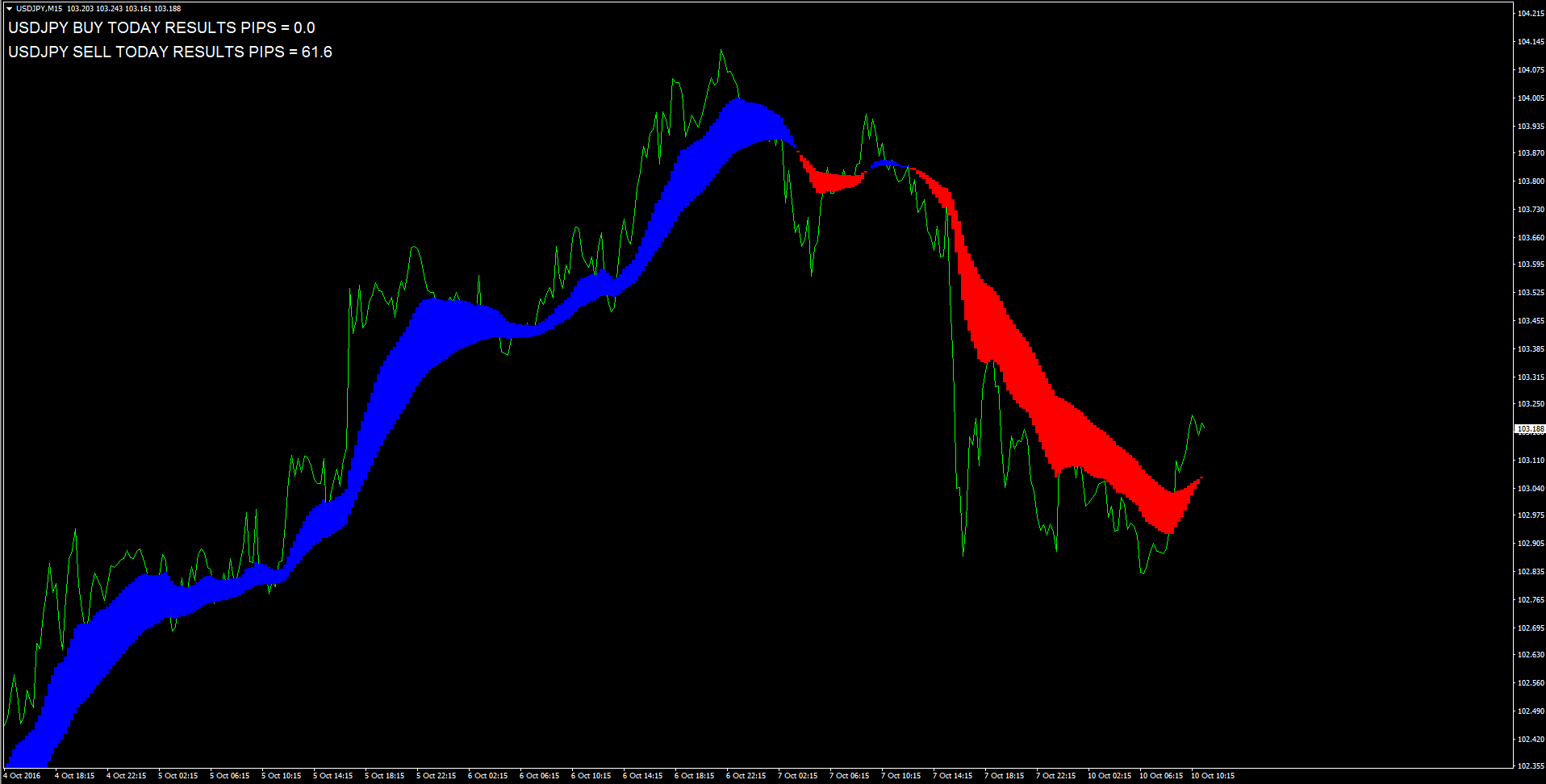

USD/JPY still targets 107.49 in the longer run Commerzbank

Senior Technical Analyst at Commerzbank Axel Rudolph suggested the pair?s upside could re-visit the mid-107.00s in the longer term.?USD/JPY is being capped by its September high at 104.32, a rise above which will target the May low at 105.55?.?Slips should find support between the 102.79 September 21 high and the 55 day moving average at 101.92?.?Longer term we suspect that the market is basing and target the 107.49 July high and the 200 day ma at 108.22 at this stage?.

NZD/USD turns back below 100-DMA

Having faced rejection at 0.7200 handle on Friday, the NZD/USD pair resumed with its near-term downward trajectory on Monday and has now dipped back below 100-day SMA.Currently trading around 0.7140 region, the greenback continues to gain traction following Friday's comments from Cleveland Fed President Loretta Mester, which reinforced market expectations of an eventual Fed rate-hike action by the end of this year and helped the US Dollar to erase disappointing NFP led minor retracement. Meanwhile, a relative empty economic docket and holiday thinned market liquidity conditions on Monday has failed to provide any respite for the pair and the pair has now moved within striking distance of Friday's two-month lows support near 0.7100 handle. Weakness below 0.7135 (Oct. 6 low) seems to drag the pair immediately towards 0.7110 (Oct. 7 low) below which the pair might continue to drift towards 0.7075-70 support area. On the flip side, recovery back above 0.7175 (session high) might continue to confront strong resistance near 0.7200 handle, which if cleared should assist the pair to stage additional recovery towards 0.7240-45 horizontal resistance.

Gold extends recovery momentum, moves back above 200-DMA

Gold extended recovery from a 4-month low touched last week but failed to clear Friday's swing high resistance near $1265 level.Currently trading around $1262 level, the precious metal has managed to move back above the very important 200-day SMA despite of Friday's comments from Cleveland Fed President Loretta Mester that continued supporting market expectations of an eventual Fed rate hike action by the end of this year. Following the comments, the yellow metal ran through fresh offers and erased disappointing headline NFP print-led its tepid recovery gains and dropped to a fresh 4-month low before settling with only marginal gains at $1256 level, sharply lower for the second consecutive week. On the first day of new trading week, Donald Trump's strong performance at the second presidential debate is fueling risk-off trade and supporting the metal's safe-haven demand.With US markets closed in observance of Columbus Day, broader market risk sentiment would be the key drive of the commodity's next leg of move on Monday. Momentum above $1265 immediate resistance is likely to get extended immediately towards $1275-77 horizontal resistance above which a strong bout of short-covering seems to lift the commodity back towards $1300 psychological mark.On the flip side, sustained weakness back below $1255 might now turn the commodity vulnerable to break through Friday's 4-month low support near $1240 region and aim towards testing its next major support near $1225 level.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.