EUR/USD: Wednesday?s low tested ahead of ECB minutes

The EUR/USD pair keeps its range around 1.12 handle, with the bears retaining control amid rising demand for the greenback across the board.Currently, EUR/USD trades -0.05% lower at t 1.1199, having posted fresh session highs at 1.1191 last hour. The main currency pair struggles to reclaim 1.12 handle as the US bulls remain in charge as the European session gets underway. The USD index trades +0.12% higher at 96.25.Moreover, a positive start to the European markets also continues to weigh on the funding currency status euro, and keeps the major in the red zone. However, the EUR appears to find support from better-than expected German factory orders data. Germany factory orders for Aug climbed 1.0% m/m vs +0.3% expectations.Focus shifts to the ECB minutes due later this session ahead of the weekly US jobless claims lined up for release in the NA session today.In terms of technicals, the pair finds the immediate resistance 1.1251 (Sept 30 high). A break beyond the last, doors will open for a test of 1.1286 (Sept 15 high) and from there to 1.1300 (round figure). On the flip side, the immediate support is placed at 1.1171 (100-DMA) below which 1.1145 (static support) and 1.1119 (Sept 21 low) could be tested.

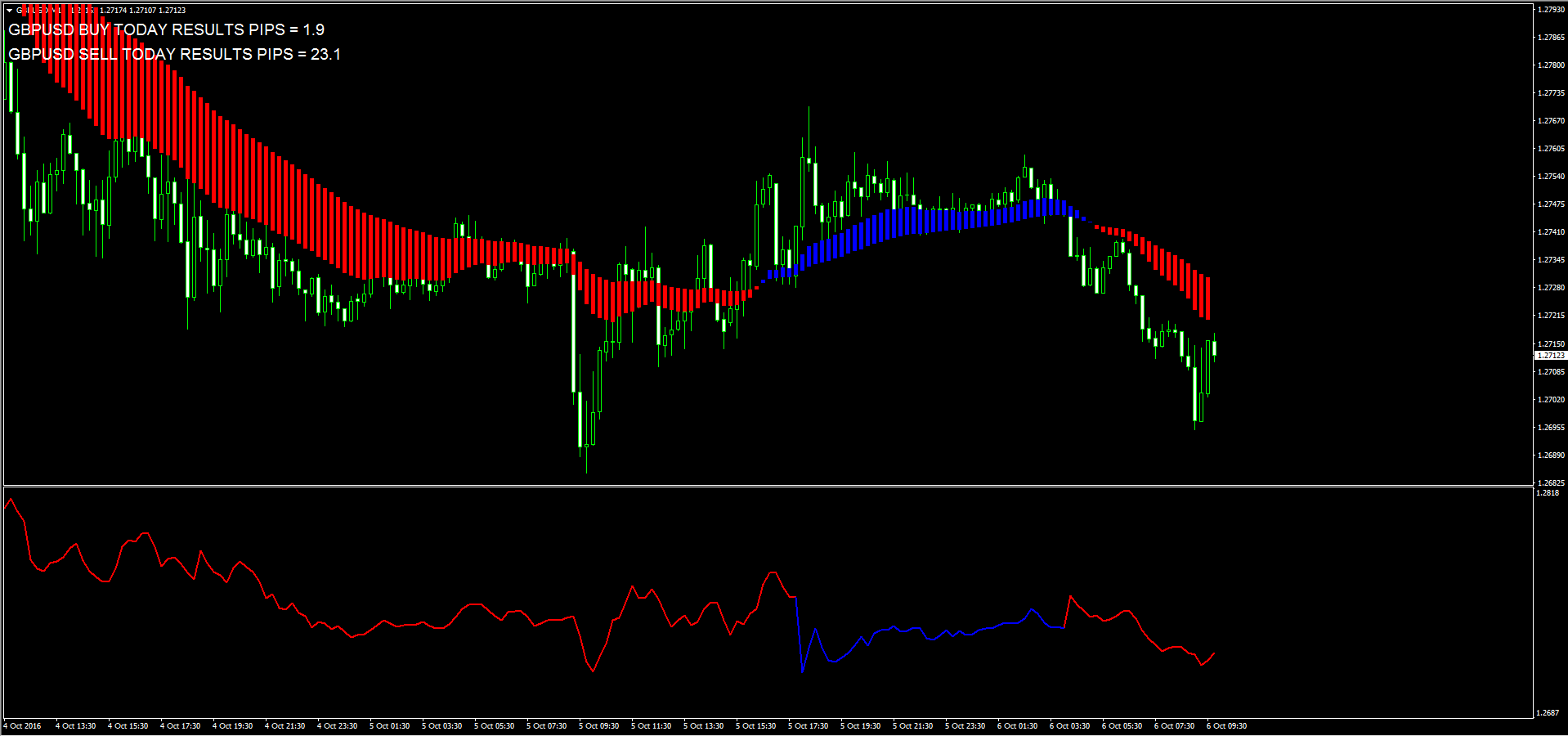

GBP/USD attention to 1.2652 - Commerzbank

Karen Jones, Head of FICC Technical Analysis Research at Commerzbank, believes Cable could attempt a test of the mid-1.2600s.?GBP/USD has recently completed its symmetrical triangle and has eroded the 1.2797/50 July low and the long term Fibonacci support (78.6% retracement of the move from 1985 to 2007). It is poised to reach the channel support at 1.2652, and this may hold the initial test (parallel line from the top of the triangle). Our target is 1.22/1.2190 (this is the approximate measurement down from the symmetrical triangle pattern)?.?We have a near term resistance line at 1.2957 (nearby high is 1.3056) and will consider that the market remains directly offered below here. We view the September high at 1.3443 as an interim high. Only if it and the late June high at 1.3534 were to be overcome would we neutralize our medium term negative outlook?.

USD/CAD toying with highs near 1.3200

The greenback remains on a firm fashion vs. its rivals this week, now lifting USD/CAD to test daily tops in the boundaries of 1.3200 the figure.Spot is reverting two consecutive sessions with losses today, on its way to re-test the key 200-day sma today at 1.3214 and opening the door for potential visits to recent highs further north of the 1.3200 handle.CAD has been so far unable to benefit from the better tone in crude oil prices, with the barrel of West Texas Intermediate flirting with the psychological mark at $50.00 following significant draws in inventories as reported by the API and EIA.Later in the session US Initial Claims and Building Permits in Canada are only expected, ahead of the speech by Senior Deputy Governor C.Wilkins, the BoC?s Business Outlook Survey and key labour market figures in Canada and the US, all due tomorrow.As of writing the pair is up 0.17% at 1.3201 facing the next resistance at 1.3276 (high Sep.27) ahead of 1.3311 (38.2% Fibo of the 2016 drop) and finally 1.3575 (50% Fibo of the 2016 drop). On the other hand, a breach of 1.3149 (20-day sma) would open the door to 1.2996 (low Sep.22) and then 1.2818 (low Sep.7).

USD/JPY digesting recent strong gains to monthly highs

The USD/JPY pair was seen consolidating recent strong gains to 4-week high level near mid-103.00s, awaiting for fresh impetus from Friday's jobs data from the US.Wednesday's release of stronger-than-expected US ISM non-manufacturing PMI negated disappointment from ADP report and helped the pair to extend its break-out momentum for the seventh straight session. With the overall US Dollar Index bouncing between tepid gains and minor losses, the pair has been confined in a narrow trading range just below 100-day SMA as traders now look forward to the September non-farm payrolls data, slated for release on Friday, which could provide some clarity over the timing of next Fed rate-hike move and drive the greenback in the near-term. A relatively thin US economic docket, featuring the release of weekly jobless claims, is unlikely to provide any meaningful momentum and the bulls might take a breather while taking cues from the overall risk sentiment.On the upside, 103.70 (100-day SMA) is likely to act as immediate resistance, which if conquered sets the stage for an immediate up-move towards 104.00 round figure mark ahead of September monthly high resistance near 104.30-32 area. Meanwhile on the downside, weakness below session low support near 103.30 level could drag the pair below 103.00 handle, towards testing a strong horizontal resistance, turned support, near 102.80-75 region.

USD/CHF advances further towards 0.9800 post-Swiss CPI

The USD/CHF pair extends gains beyond 200-DMA and now heads for a test of 0.98 handle, as the US dollar finds renewed bids as we step into the European session.USD/CHF extends further on Swiss CPICurrently, the USD/CHF pair trades 0.35% higher at fresh session highs of 0.9778, with a test of 0.98 handle now inevitable. The USD/CHF pair caught a fresh bid-wave as the Swiss franc was hit badly by a softer Swiss CPI print. Switzerland CPI for Sept stood at +0.1% m/m vs +0.2% expectations and -0.1% previous.Moreover, fresh buying witnessed in the greenback against its major peers also spurred fresh rally in the USD/CHF pair. The USD index now rises +0.21% to 96.34 levels, as against +0.10% seen earlier.Next of note for the major remains the US weekly unemployment claims data due later in the NA session, while the payrolls figures will be published on Friday.To the upside, the next resistance is located at 0.9820/29 (Aug 20 high/ 5-week high) and above which it could extend gains to 0.9850 (psychological levels) and 0.9889 (Sept 1 high) next. To the downside, immediate support might be located at 0.9735 (20-DMA) and below that 0.9700 (round figure) and from there to 0.9643/35 (Sept 30 & 2 low).

Gold extends losses for 8th consecutive session, inching closer to 200-DMA

Gold extended losses for the eight consecutive session and remained close to over 3 1/2 month lows touched on Wednesday, inching closer to the very important 200-day SMA. Currently trading around $1265 region, the precious metal extended losses for the eighth consecutive session and seems to be heading back towards yesterday's multi-month lows. A sharp rise in the US services sector activity dented the metal?s investment appeal on Wednesday and the metal reversed tepid recovery gains to turn negative after the US ISM non-manufacturing PMI printed an 11-month high reading of 57.1 in September and surpassed even the most optimistic estimates. Meanwhile, reviving hopes of an eventual Fed rate-hike action later this year continued driving the US Dollar higher, which tends to weigh on dollar-denominated commodities - like gold. Adding to this, buoyant US equity markets drove investors away from the traditional safe-haven assets - like Yen, bonds and gold. Focus now shifts to one of the most keenly watched US economic indicators, monthly jobs report, scheduled for release on Friday, which would provide fresh clues over the possibilities of the Federal Reserve 's next monetary policy move and trigger the next leg of directional move for the commodity.Immediate downside support is pegged near $1260-58 region (200-day SMA), which if broken decisively might open room for a fresh leg of depreciating move for the commodity initially towards $1250 level support and eventually towards its next major support near $1235 region.On the upside, $1270 level now becomes immediate resistance above which the recovery could get extended towards Wednesday's high level of $1277. Momentum above $1275-77 resistance could boost the commodity further but any further up-move might now be capped at $1290 strong horizontal resistance.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.