EUR/USD trims losses, around 1.1215/20 ahead of Fedspeak

The common currency has recovered the ground lost to the buck earlier in the session, now pushing EUR/USD back towards the 1.1215/20 band.Spot remains locked within a narrow range for the time being, finding decent support in the 1.1180 area after ECB?s M.Draghi reiterated the need for structural reforms in order to spur growth in the region at today?s First ECB Annual Research Conference in Frankfurt (nothing new here).Ahead in the session, the Exchange of Views by President Draghi on ?Current developments in the euro area? in Berlin will bring back the focus on EUR, while Yellen?s testimony before the House Panel will take the bulk of the markets? attention later in the NA session.Further events include August?s Durable Goods Orders and speeches by St. Louis Fed J.Bullard (voter, neutral), Chicago Fed C.Evans (voter 2017, dovish) and Cleveland Fed L.Mester (voter, hawkish and one of the triple dissenters at the last FOMC meeting).Adding to potential choppiness around the pair, Deutsche Bank remains in the spotlight following news that the German government could be elaborating a rescue package. The pair is now losing 0.01% at 1.1216 and a breakdown of 1.1188 (low Sep.27) would open the door to 1.1158 (200-day sma) en route to 1.1133 (2014-2016 support line). On the flip side, the next hurdle aligns at 1.1267 (resistance line off 2016 high) ahead of 1.1329 (high Sep.8) and finally 1.1367 (high Aug.18).

GBP/USD inter-market: Recovery attempts above 1.3000 likely to be short-lived

GBP/USD extends its downside consolidation phase around 1.30 handle into a third-day so far this week, with markets considering every attempt to sustain above 1.30 handle as a good selling opportunity.The cable continues to remain under pressure largely on the back of persistent US dollar strength, backed by markets pricing-in a Clinton win after the first US presidential election debate. While reports of UK?s month end subsidy payment to EU also remains one of the key catalyst behind the bearish momentum in the major.Meanwhile, the latest leg lower in the GBP/USD pair is mainly driven by the dovish comments from BOE deputy governor Shafik, who noted that more stimulus will be required ?at some point?, while adding that the central bank could also expand its asset purchase program.However, the losses remain capped as the bulls find support from the yield differential between 10-year treasury and Gilt yields tilting in favor of the GBP. Later today, the major is likely to remain pressured as the greenback is likely to pick-up further strength of a string of Fed speaks and US durable goods data due later in the NA session.

USDCAD rally has stalled near 1.3280 - RBC CM

Adam Cole, Research Analyst at RBC Capital Markets, suggests that the rally in USD/CAD has stalled near 1.3280 after the pair took out a key triple top at 1.3219.?CAD/MXN remains under pressure though, as a bearish key reversal day in USD/MXN has spurred broader MXN gains. The cross features initial support at 14.6417, with a close below here targeting 14.3940.There are no data releases in Canada today, though the outcome of the OPEC meeting in Algiers may trigger some volatility. Our commodity strategists expect the cartel to opt for a pragmatic approach that results in a moderately constructive framework, which could leave the door open for some sort of action at the November OPEC gathering. Initial resistance is located at 1.3281 and 1.3312, followed by the 1.3402/46 region. Support is located at 1.3160 and 1.3118.?

EUR/JPY fades a spike to 113.10, Fed speaks, Draghi eyed

A renewed rally seen in the EUR/JPY cross appears to fizzle, as the EUR/USD pair recedes gains spurred by fresh reports of Deutsche bank rescue plans.EUR/JPY rejected near 5-DMA at 113.06.The EUR/JPY pair rises +0.28% to 112.95, having quickly reversed a spike to session highs of 113.10. EUR/JPY failed to resist above 113 handle as the EUR bears fought back control after Germany's Federal Financial Supervisory Authority (BaFin) dismissed latest reports that the government and financial authorities are preparing a rescue plan for the troubled Deutsche bank. However, the retreat from above 113 handle remains capped on the back of fresh buying seen around USD/JPY, as risk appetite improves in wake of rallying European stocks and higher oil prices. All eyes now remain on a string of Fed speaks and ECB Draghi?s speech due later today for further momentum on the cross.The pair has an immediate resistance at 113.50 (psychological levels) and from there to 113.88 (50-DMA) and 114.00 (20-DMA) next. On the flip side, next supports are seen at 112.64 (1h 200-SMA) and 112.50 (psychological levels) below which it could extend losses to towards 112.02 (post-FOMC low).

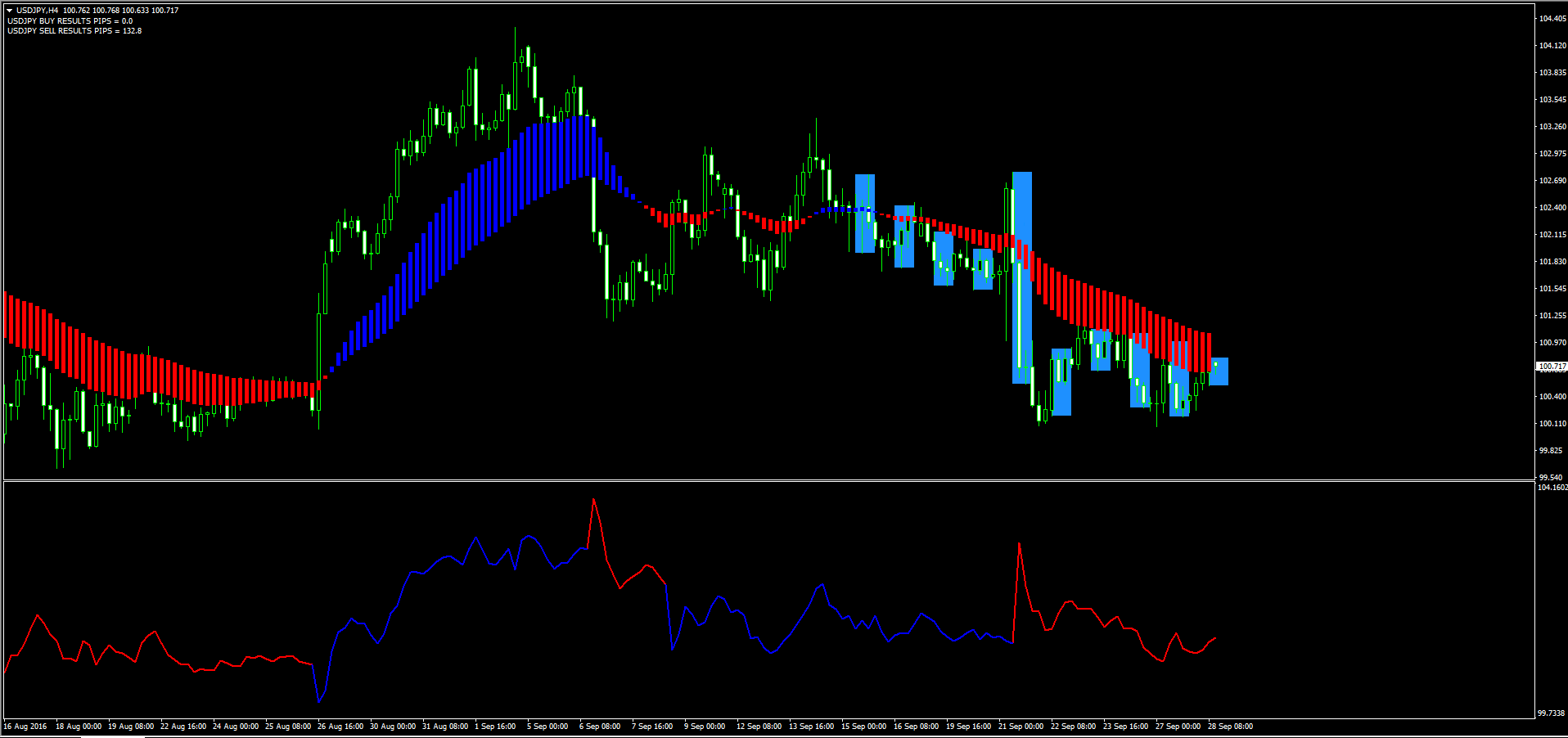

USD/JPY hits fresh session high as risk appetite improves

The USD/JPY pair maintained its bid tone and is seen extending its recovery from the vicinity of 100.00 psychological mark, retested on Tuesday.A broad based recovery in European equity markets boosted investor risk appetite and driving them away from perceived safety of the Japanese Yen. The pair is benefitting from the prevalent risk-on sentiment and is currently trading near session high around of 100.75-80 band.Despite of its recovery on Wednesday, the recovery seems to lack momentum as market participants already seem to have ruled out possibilities of a Fed rate-hike action in November. Hence, focus would now turn to the Fed Chair Janet Yellen's testimony, later during NY trading session, which might provide fresh clues over the central bank's near-term monetary policy outlook and eventually drive the greenback further from current levels. On the economic data front, monthly durable goods orders from the US might provide impetus for short-term traders.Omkar Godbole, Editor and Analyst at FXStreet, notes, "Pair?s repeated failure to sustain above 101.00 levels and a day end close below 100.71 (50% of 2011 low ? 2015 high) adds credence to the possibility of a bearish break below 100.00 levels as suggested by falling top formation despite repeated rebound from 100.00 levels post Brexit. Breach of 100.00 levels on intraday basis could be enough to send prices lower to 99.00 levels.""Bearish invalidation is seen only if prices see a daily close above 101.24 (Sep 23 high + descending trend line hurdle). Such a move appears likely only if the US data beats estimates by a wide margin, although wobbly equity markets amid banking concerns in Europe could still play a spoil sport."

Gold extends weakness further below 50-DMA

Gold extended Tuesday's break-down momentum from 3-day old trading range and maintained its bearish bias below 50-day SMA for the second consecutive session.Currently trading at a 5-day low level of $1324, the yellow metal is weighed down by a broadly stronger greenback. Tuesday's US consumer confidence data and hawkish comments from Federal Reserve Vice Chairman Stanley Fischer provided a boost to the US Dollar, which tends dent demand for dollar-denominated commodities, and provided the required momentum for gold prices to break through the recent consolidation phase. "Gold broke below the 1333/31 area yesterday but is clinging onto the 1324 area....Now if we start to break below 1321 we would assume we are trading lower and looking once more at the 1310/04 support evident from the weekly charts....Maybe Gold wasn't ready to break the 1344 area just yet...given we have been overbought.....we may well still be oscillating within this range we are seeing.....since really June.....so weeklies remain positive.....we buy weakness on the premise that we break the 1344 resistance at some stage..."Next in focus would be the release of monthly US durable goods orders and the Fed Chair Janet Yellen's testimony later during NY trading session, which will be looked upon to grab short-term trading opportunities.On a sustained weakness below $1322-20 immediate support, the metal seems to aim towards testing 100-day SMA support near $1310 region. Meanwhile on the upside, recovery momentum above session high resistance near $1327-28 level might now be capped at 50-day SMA support break turned strong resistance.?

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.