IFO Preview: what to expect of EUR/USD

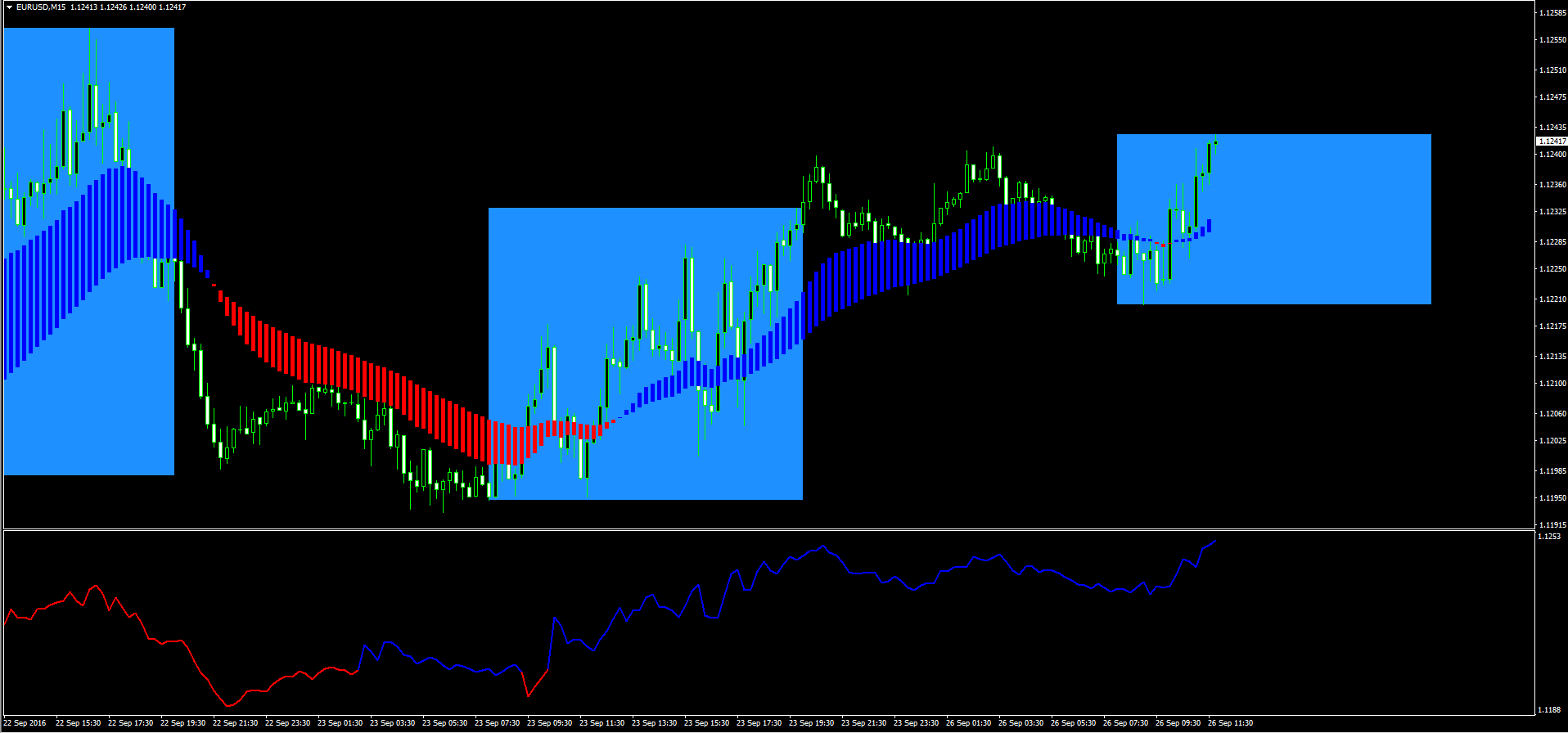

The German IFO is due later in the European morning. Market consensus expects both Business Climate and Current Assessment to improve during the current month, although the Expectations component is seen just a tad lower.Anyway, the indicator is expected to keep the downtrend since recent tops in June, with confidence amongst investors still not restored and ?Brexit? uncertainty lingering.Regarding FX and barring any big surprise on either direction, EUR/USD is expected to pay little attention to today?s releases, more concerned instead on the USD-dynamics and particularly on the timing of the next Fed?s rate hike. Of note, however, remains the area around 1.1275/80, where the resistance line off 2016 tops keeps capping occasional gains. On the downside, the key 200-day sma today at 1.1157 emerges as the initial target, ahead of the 2014-2016 support line at 1.1147.

GBP/USD flirting with lows near 1.2930

The Sterling is now surrendering initial gains and has dragged GBP/USD to test the area of daily lows in the mid-1.2900s. Spot is retreating for the second session in a row so far today, coming down from last week?s peaks in the vicinity of 1.3130 following some pick up in the buying interest around the buck.On the UK?s data front, Mortgage Approvals by BBA are only due today, although the broader risk appetite trends and USD-dynamics remain poised to drive the mood around the pair. Regarding positioning, GBP speculative longs have increased significantly by around 30K contracts during the week ended on September 20, while net shorts have been trimmed to the lowest level since early July and Open Interest has receded to 7-week lows, all according to the latest CFTC report.GBP/USD levels to consider As of writing the pair is losing 0.08% at 1.2945 facing the next support at 1.2863 (low Aug.15) and then 1.2796 (2016 low Jul.6). On the other hand, a breakout of 1.3125 (high Sep.22) would open the door to 1.3447 (high Sep.6) and finally 1.3584 (100-day sma).

USD/JPY struggling to move back above 101.00 handle

The USD/JPY pair faded a bullish spike beyond 101.00 handle and turned back into negative territory after comments from BOJ Governor Haruhiko Kuroda failed to convince traders that the central bank would opt to add further monetary stimulus. Speak at the meeting with business leaders, in Osaka, BOJ Governor Haruhiko Kuroda that the central bank is ready to act and could deepen negative rates, or do more QE, if needed. The pair, however, ignored dovish comments and reversed quickly to currently trade around 100.85-80 band. Meanwhile, the prevalent weakness in Asian equities was also seen supporting the safe-haven appeal of the Japanese Yen and, thus capped any further recovery for the major. Later during NA session, traders will confront the release of new home sales data from the US and would also be awaiting the first US Presidential debate between Hillary Clinton and Donald Trump later on Monday. On a sustained move above 101.00 handle, the pair is likely to extend its recovery towards 101.35-40 resistance above which the recovery trend could get extended towards 101.85 resistance. On the flip side, weakness below session low support near 100.70 region is likely to accelerate the downslide to 100.30 support area, which if broken might turn the pair vulnerable to break through 100.00 psychological mark and head towards August monthly lows support near 99.65-60 region.

USD/CAD digesting Friday?s strong gains

The USD/CAD pair was seen digesting Friday's strong gains and traded in a 30-pips range amid prevalent risk-off sentiment. Currently trading around 1.3170, the pair on Friday registered strong gains and jumped back above the very important 200-day SMA following the release of disappointing Canadian CPI and monthly retail sales data. Furthermore, a sharp slide in crude oil prices also added on to the offered tone around the commodity-linked currency, loonie, and provided an additional boost to the pair on Friday.On Monday, cautious investor sentiment is seen extending supporting the US Dollar, while rebound in oil prices capped further up-move and confined the pair within a narrow trading range. On Monday, the release of new home sales data from the US might provide some fresh impetus but broader sentiment would continue to be driven by price-action surrounding oil prices. Immediate upside resistance is pegged at 1.3200 round figure mark above which the pair is likely to aim towards retesting monthly high resistance near 1.3245-50 region before heading towards its next major resistance near 1.3285-90 region. Meanwhile on the downside, weakness below session low support near 1.3150 now seems to find support at 1.3130 horizontal zone, which if broken could drag the pair back towards 1.3100 handle.

GBP/JPY fast approaching 130.00 handle

The GBP/JPY cross failed to build on to its early recovery momentum and turned sharply lower to hit a fresh monthly low.Currently hovering around 130.20 region, the lowest level since August 18, the cross traded in negative territory for second straight session amid renewed selling pressure around the British Pound. Market expectations of a "hard" Brexit seems to have made a comeback after Friday's comments from UK Foreign Secretary Boris Johnson that UK would officially begin the Brexit negotiations early in 2017 and is weighing on the sterling across the board.Meanwhile, market seems to have ignored dovish comments from BOJ Governor Kuroda, indicating central bank's readiness to act, amid prevalent risk-off sentiment, which seems to provide an additional boost the safe-haven appeal of the Japanese Yen and exerting further selling pressure around the GBP/JPY cross.With an empty UK economic docket, the cross would continue to take cues from the broader market sentiment and any further news surrounding the historic Brexit referendum. From current levels, 130.00 psychological mark seems to act as immediate support, which if broken is likely to accelerate the slide immediately towards August lows support near 129.15 region before the pair eventually drops to test post-Brexit swing low near 128.90 level. On the flip side, any recovery attempts might now confront immediate resistance near 130.50 level above which the momentum could get extended towards 131.50 horizontal zone with 131.00 round figure mark acting as intermediate resistance.