The US dollar posted some strong gains today, following the release of data showing price pressures building up in the US economy. The yen also posted some gains versus the pound and the euro, as it traded below the 134 and 114 levels respectively.

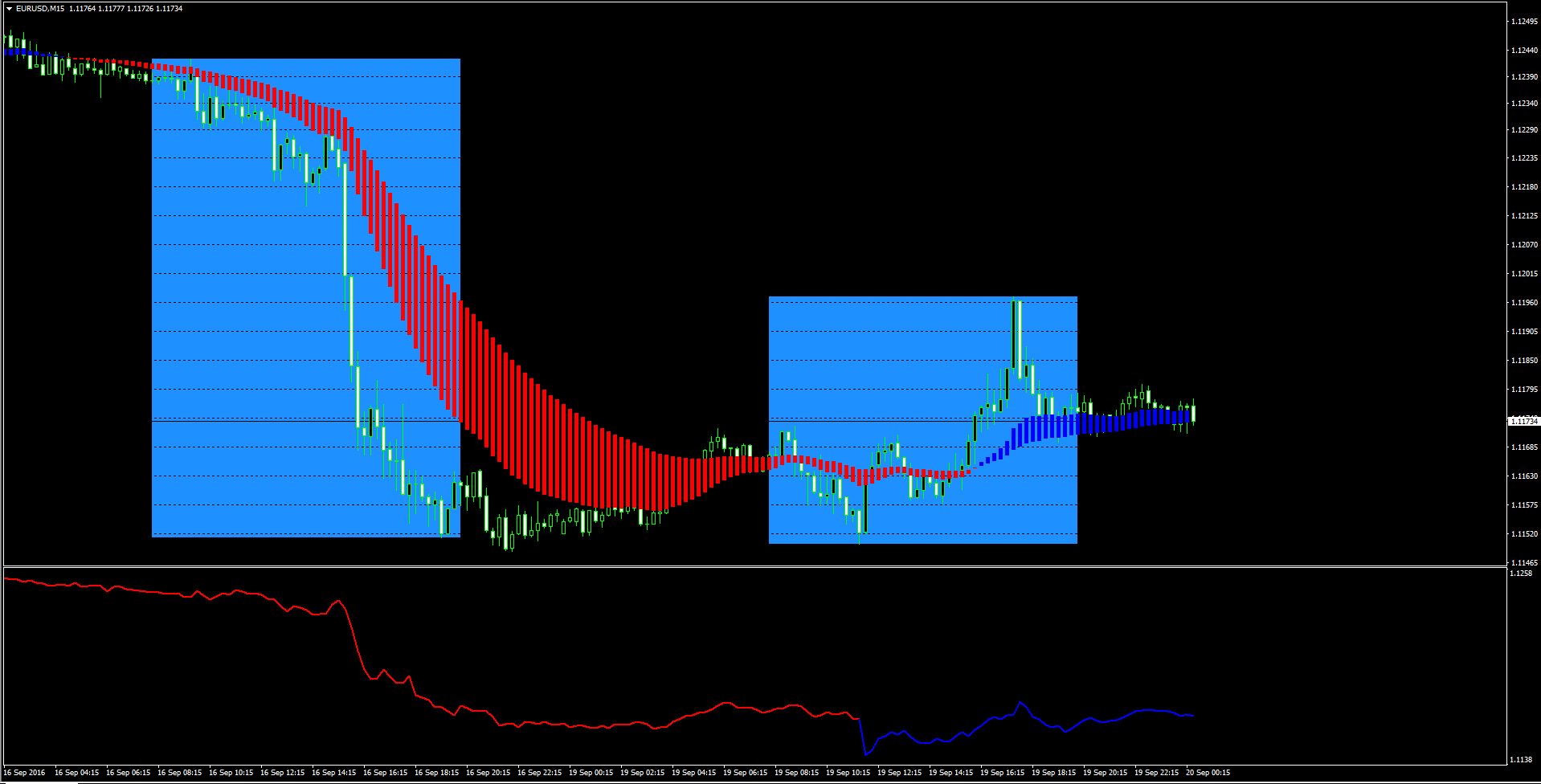

EUR/USD fell to its lowest since September 6, falling below the 1.12 level to 1.1166. USD/JPY did not rise as much, with the dollar retaking the 102 handle to trade around 102.15. The pound was the biggest casualty against the dollar as cable dropped below 1.31 to a 2-week low. During today?s Asian session cable had traded as high as 1.3250.

In the day main economic news release, US inflation rose faster than expected during August, as both headline and core consumer prices rose by 0.2% and 0.3% respectively against a rise of only 0.1% and 0.2% as expected by analysts. The year on year rate of increase rose to 1.1% for headline inflation while for core inflation excluding food and energy the annual rate of change was 2.3%. A rise in healthcare and housing rent costs were behind much of the increase, counterbalancing a drop in gasoline prices.

The latest inflation numbers will probably embolden the hawks on the Fed?s rate-setting committee, although on balance given the latest weak ISM survey data, slowdown in hiring and disappointing retail sales figures that were released the previous day, the Fed is likely to hold rates next week. Still, if inflation continues on this trend and energy prices also eventually stabilize, the Fed could be forced to acknowledge the presence of pressures and raise rates from their current very low levels.

The dollar managed significant gains versus the euro and sterling immediately following the data, but was not as successful in rallying against the yen or indeed the Australian dollar.

Later in the day, University of Michigan preliminary consumer sentiment came out on the negative side. The index failed to rise from the previous months level as analysts had expected. The current conditions index dropped sharply but there was a rise in the expectations index. Interestingly, 1-year inflation expectations dropped to 2.3% from the previous month?s 2.5%.

In commodities, oil continued to trade with a negative momentum as US futures broke below $43 to as low as $42.73, whereas gold fell below $1310 an ounce to find a low of $1306 as dollar strength hit the precious metal.

Next week is expected to start slow because of a Japanese national holiday and traders will be anxiously waiting for Wednesday monetary policy announcements from the Bank of Japan and the Federal Reserve. The Fed statement will be accompanied by a quarterly forecast update and followed by a press conference of Chair Janet Yellen.