The US dollar proved resilient in the face of some worse than expected economic news whereas the Bank of England rate setting meeting confirmed expectations that the Bank would hold off from extra stimulus for now.

Retail sales in the United States were broadly weaker in August, as the headline measure contracted by 0.3% whereas the previous month rate was revised slightly higher to 0.1%. The retail sales control measure, which excludes certain volatile spending categories and which is closely related to the consumption component that goes into GDP calculations, missed estimates by a wide margin. Instead of rising by 0.3% month on month, it actually fell by 0.1% and the previous months reading was also revised downwards to -0.1% from an initially reported 0% growth rate.

Producer prices did provide some hints that inflation could be picking up as PPI excluding food and energy rose at a 1.2% year on year rate compared to July 0.8% pace. In other data, industrial output for August was also disappointing as it fell by 0.4% compared to expectations it would drop 0.3%. There was also a slight downward revision in the previous months growth rate.

There were also some good news for the US economy however, as weekly initial jobless claims stayed very low at 260 thousand, indicating that the pace of layoffs was quite slow. The Philly Fed index came in much stronger than expected at 12.8.

In view of the multitude of data that was released, the dollar spiked down at first but then managed to rebound both against the euro and against the yen. Euro / dollar traded as high as 1.1284 but fell back to 1.1232 while dollar / yen dropped to 101.89 but recovered to 102.59. The dollar resilience particularly in light of the weak retail sales numbers was certainly impressive, but the figures have now made a September rate hike extremely unlikely. The recovery of the dollar was particularly damaging to gold, which plunged as low as below $1310 an ounce, a near 2-week low.

The focus tomorrow will switch to US consumer price inflation for August, which apart from a few housing reports next week, will be the last significant piece of economic data the Federal Reserve Open Market Committee members will take with them in their September 20/21 meeting.

Earlier in the day, UK data showed the consumer there in high spirits during August, as the figures handily beat estimates and there were significant upward revisions to the previous months numbers. Headline retail sales fell by 0.2% month-on-month compared to a 0.4% rate expected by economists, while the year-on-year rate of increase was a solid 6.2%.

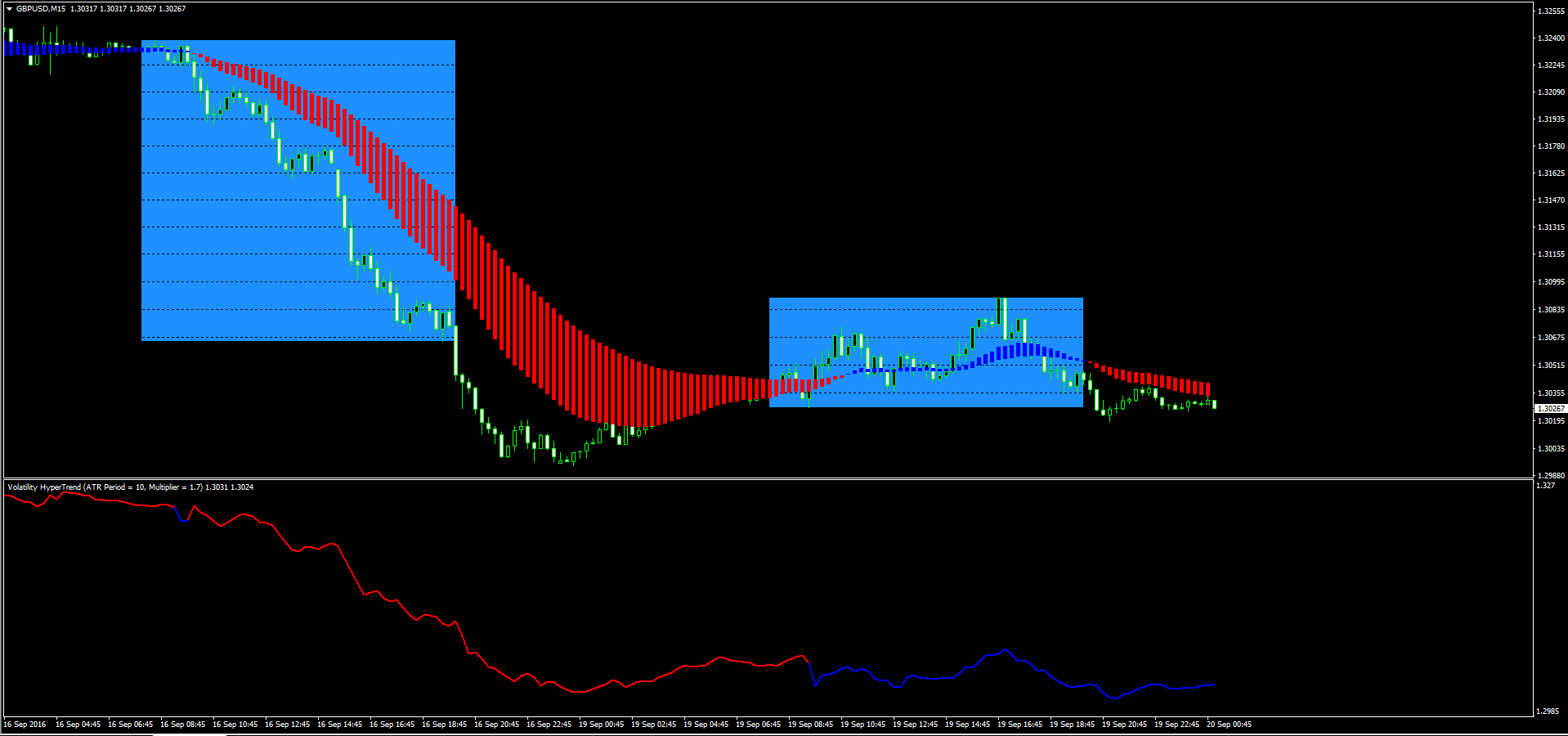

The Bank of England decided to hold rates at 0.25% today and refrained from adding further stimulus as it admitted the economy was doing better than was feared at the previous meeting. However, it attributed some of the improvement in economic conditions to the prompt action it took by cutting rates and deciding on additional Quantitative Easing. Most of the Monetary Policy Committee members appeared predisposed to cut rates again in November if necessary. The Bank did not have much impact on sterling and indeed the currency dropped back below 1.32 versus the US dollar and the euro rose north of 85 pence versus the pound. At the time of writing GBP/USD was at 1.3185 and EUR/GBP was trading at 0.8518.